Advanced international payment processing

Go above and beyond borders

Global businesses need global payments. Attract larger corporate clients by offering them advanced payment features that other banks don’t. Available alongside our FX solution or as a standalone feature – you’ll get complete oversight and authority over your cross-border transactions.

Benefits you can bank on

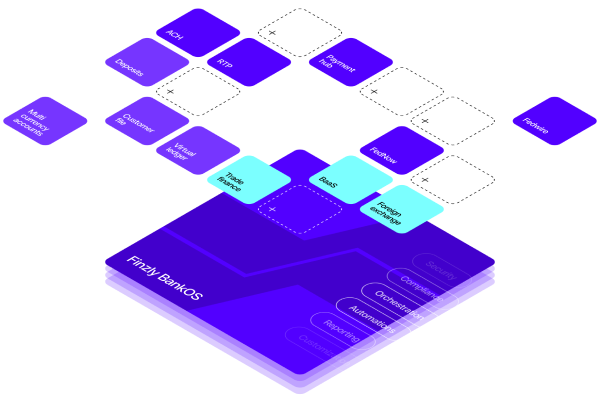

Seamless integration

Because our platform works seamlessly on top of yours, you’ll enjoy hassle-free integration with your core and other systems.

Cost-effective compliance

Stay one step ahead of ever-evolving payment standards and regulations. And stay compliant without the burden of costly upgrades.

Cross-sell and upsell

Boost your bottom line with new revenue streams from services such as foreign exchange and trade finance. Encouraging use through intuitive, best‑in‑class experiences.

Swift migration to ISO 20022 standards

Transition smoothly to the ISO 20022 messaging standard for Swift through our MX‑ready platform ahead of the migration deadlines.

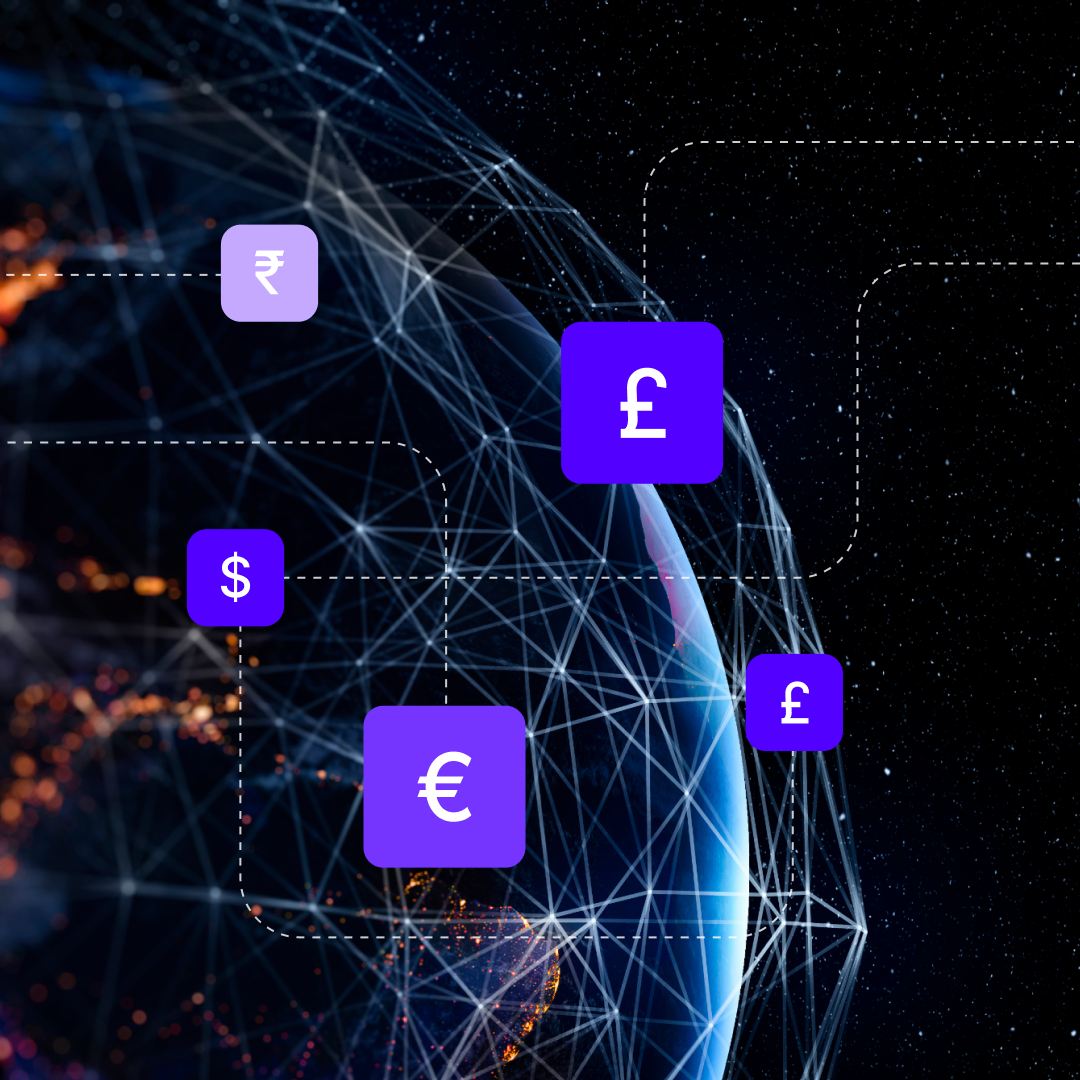

Multi‑currency support

Give your customers the freedom and flexibility of multi-currency payments. Available in a wide range of foreign currencies.

Real‑time visibility and reporting

Get complete visibility of your payments, and unfettered access to reporting tools. Monitor the status of transactions, and make informed decisions.

Extensive partner ecosystem

Harness the power of our partner ecosystem for real‑time pricing, liquidity provision and connections to Swift network.

Compliance reporting

Stay compliant with built-in DTCC and Dodd‑Frank regulations that automatically update with changes. Protect your business from AML and KYC risks.

Netting and splitting settlements

Optimize settlement efficiency by netting in multiple transactions or splitting transactions to multiple settlements.

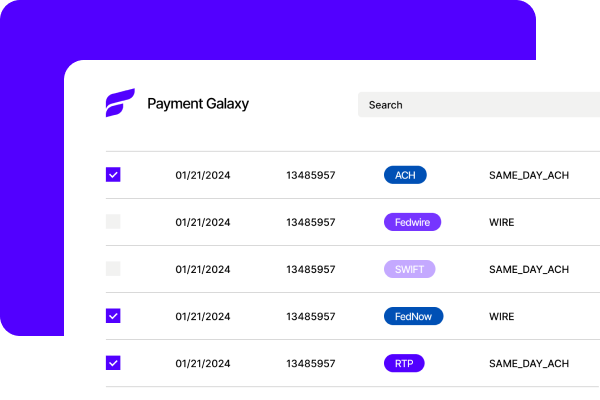

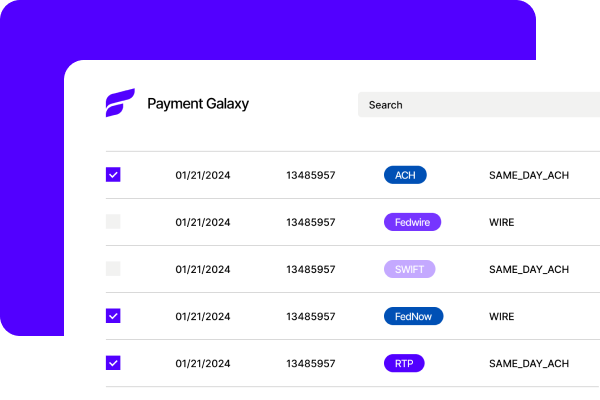

Finzly Payment Hub

Manage all payment rails in a modern, unified experience.

ISO 20022 compliance made easy for Swift MX

Remove the headache of complexities with new regulatory standards. Our SaaS platform handles all the heavy lifting. So you can focus on your core business, and we’ll manage the migration to ISO 20022.

Powered by a scalable, real‑time, 24/7, resilient architecture

Insights

Finzly Announces New Collaboration with Corpay Cross-Border to Deliver an Enhanced FX Offering for Financial Institutions

Immediate cross-border payments are becoming a reality

United Community Partners with Finzly to Expand FX Digital Banking Services

Bespoke FX Services: Driving Success for Financial Institutions

Growth strategies in foreign exchange: Synovus, First Citizens share their experience

Webinar On Demand – Growth strategies in Foreign Exchange: Synovus, First Citizens share their experience