Bank transformation, radically simple.

Award-winning innovation engineered for the real challenges of modern banking.

Finzly delivers speed, agility, modernization, and radically simple payments through core-independent, API-first, cloud-native, and international banking solutions.

Lost market share

Fintech-powered solutions are driving customers away from traditional financial institutions.

Finzly's modern solutions provide the features and speed to market FIs need to compete with fintechs.

Legacy technology

Legacy payment platforms are expensive to operate and can't adapt to market changes.

Finzly's API-first, cloud-native payment platform empowers FIs to reduce technical debt and drive innovation.

Cumbersome processes

Operational processes are labor intensive and lack flexibility, reducing efficiency.

Finzly's composable workflows give teams the freedom to create processes aligned with customer needs.

Regulatory complexity

Regulations and standards are rapidly changing, growing in number and complexity.

Finzly’s cloud-native solutions deliver automatic updates giving FIs the capabilities to stay compliant.

Future-ready innovation. Legacy-free execution.

Compete today with a proven platform built for tomorrow. Make changes effortlessly, at the speed you need.

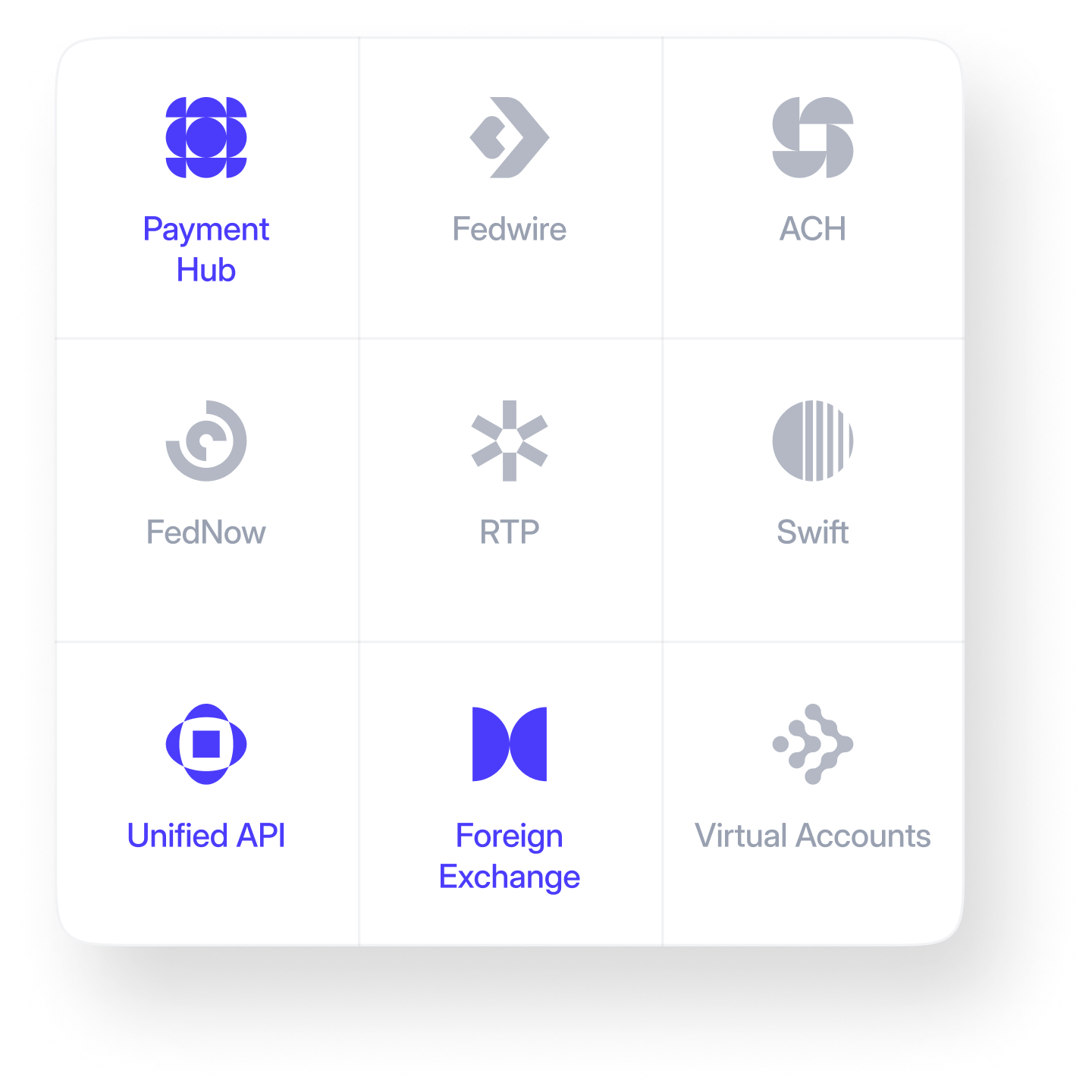

Banking without limits through a connected ecosystem

Finzly empowers banks with an ecosystem of products designed for speed, agility and efficiency.

Celebrated solutions, built for your growth.

Finzly has collected 20+ awards for its platform in the last 2 years.

Partner ecosystem

Insights

Credit unions must embrace instant payments or be left behind

Webinar on demand: Maximizing ROI of payments transformation — what banks need to know

Surround, Shrink, Scale: The Legacy Exit Strategy for Payment Modernization

The Creeping Payments Crisis: Why 70% of Large Banks Are Falling Behind in Payments

Webinar On Demand: Radically Simple Instant Payments: How Credit Unions Can Quickly Modernize Payment Infrastructure

Instant Payments Made Easy: How credit unions can quickly modernize payment infrastructure

3 Ways FIs of All Sizes Benefit from Higher RTP Dollar Limits

Instant payment adoption: Are banks future-proofing or self-limiting?