Modern FX solutions for financial institutions

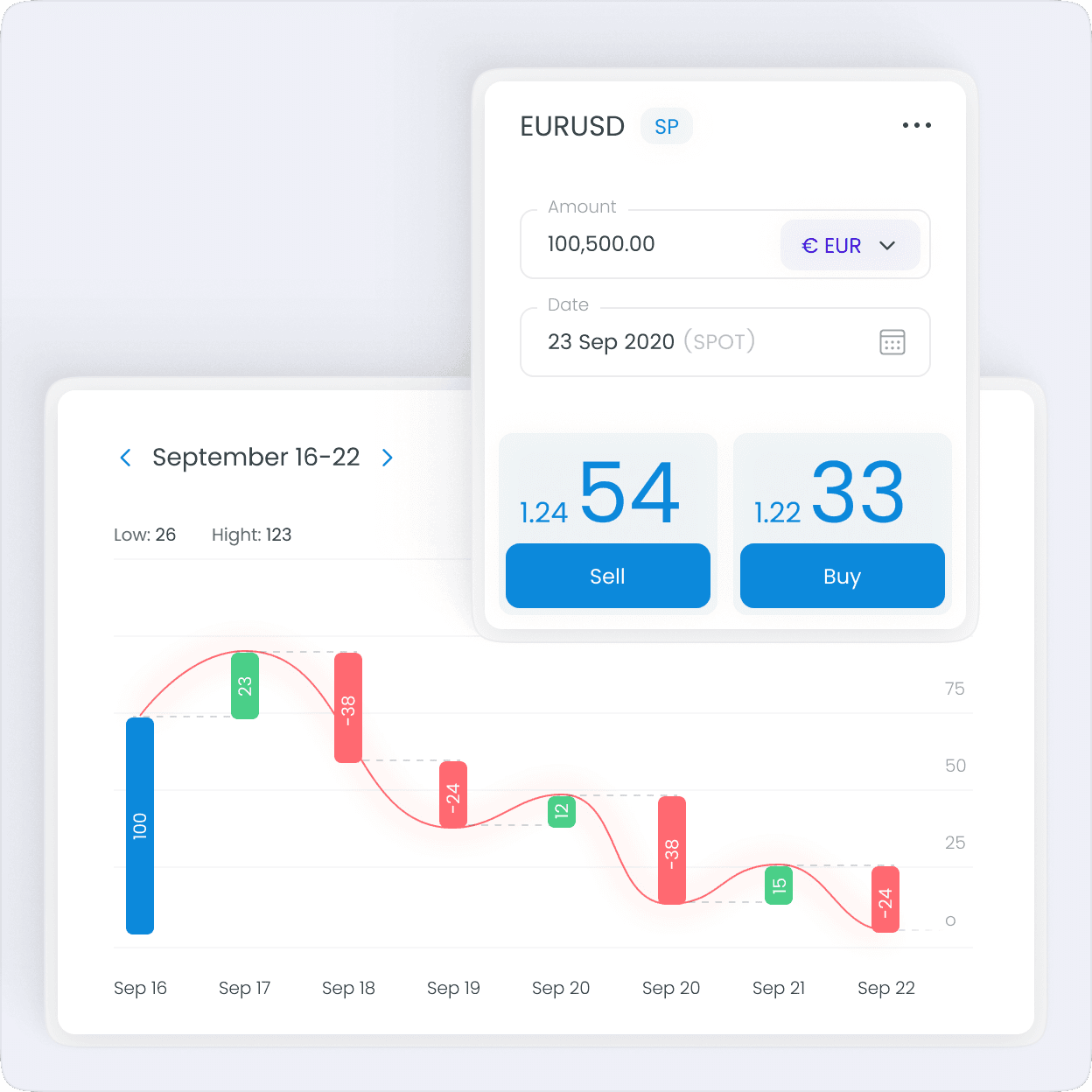

Empower your institution to offer real-time FX trading, payments, and liquidity management — all in a unified, API-first and ISO 20022-ready platform built for speed, automation, and profitability.

Whether you’re building a modern FX desk or embedding global capabilities across customer channels, Finzly makes it easy to go live quickly, stay compliant, and scale with confidence.

ISO 20022-native processing

Integrated compliance & disclosures

Streamlined reconciliation

GAAP/IFRS- compliant accounting

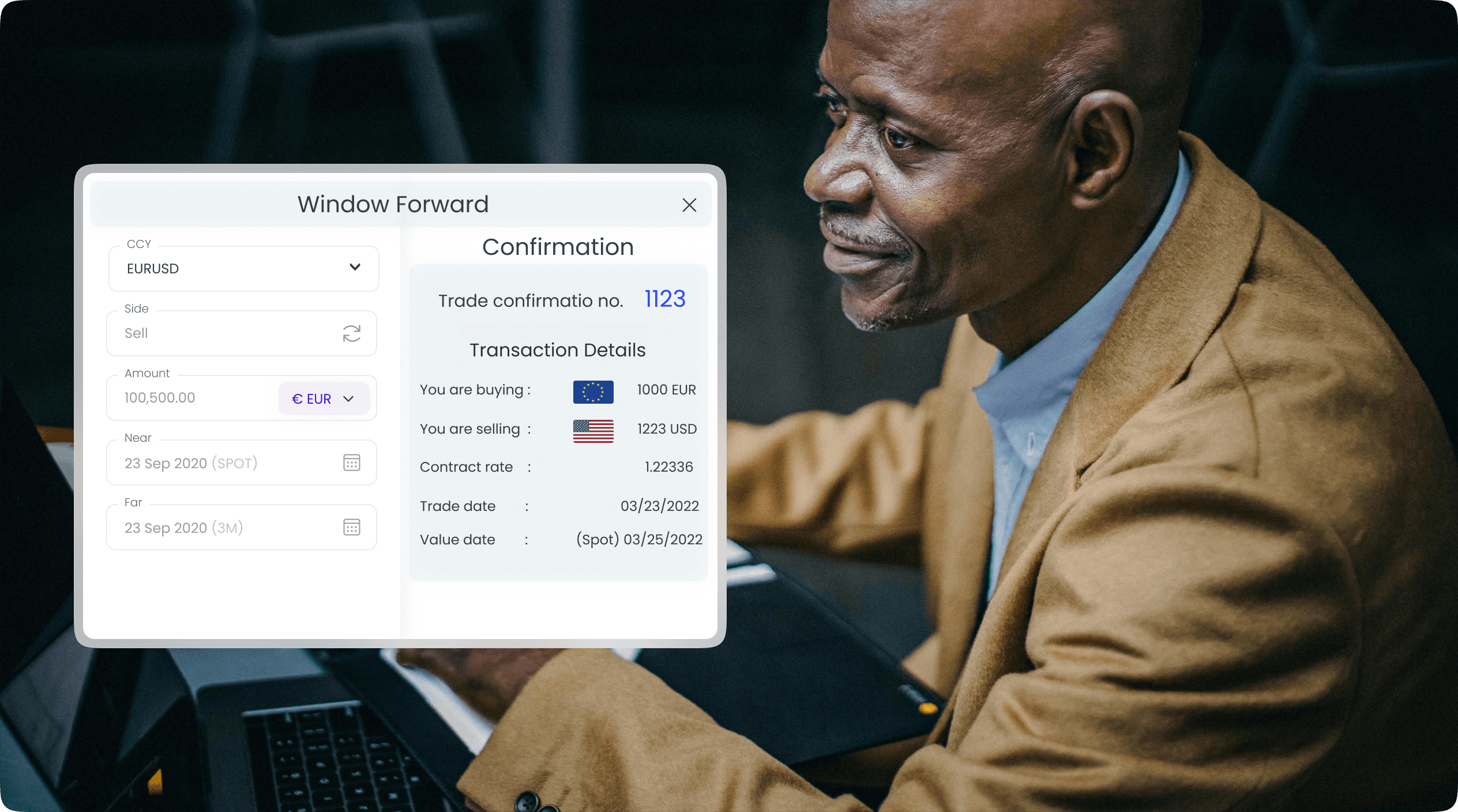

Build a revenue-generating FX business

Launch a complete FX platform that attracts business clients and delivers real-time performance and insight.

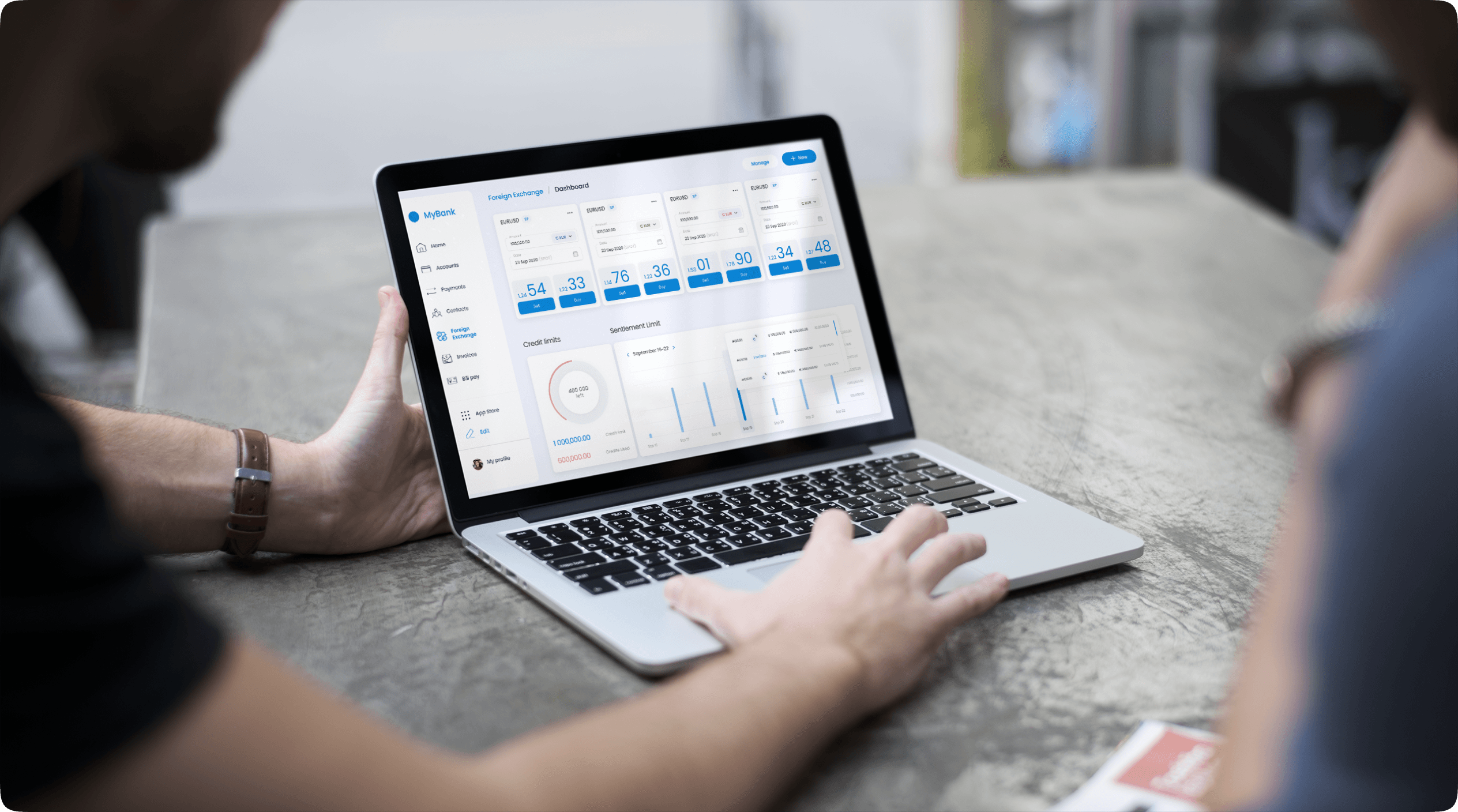

Speak with an FX expertTrade, pay, manage — all in one place

Deliver a seamless experience for clients with a unified transaction banking platform that supports FX, trade finance, and global payments.

Read the case study

Get the Finzly edge through our insights

Have any

questions?

Everything you need to know