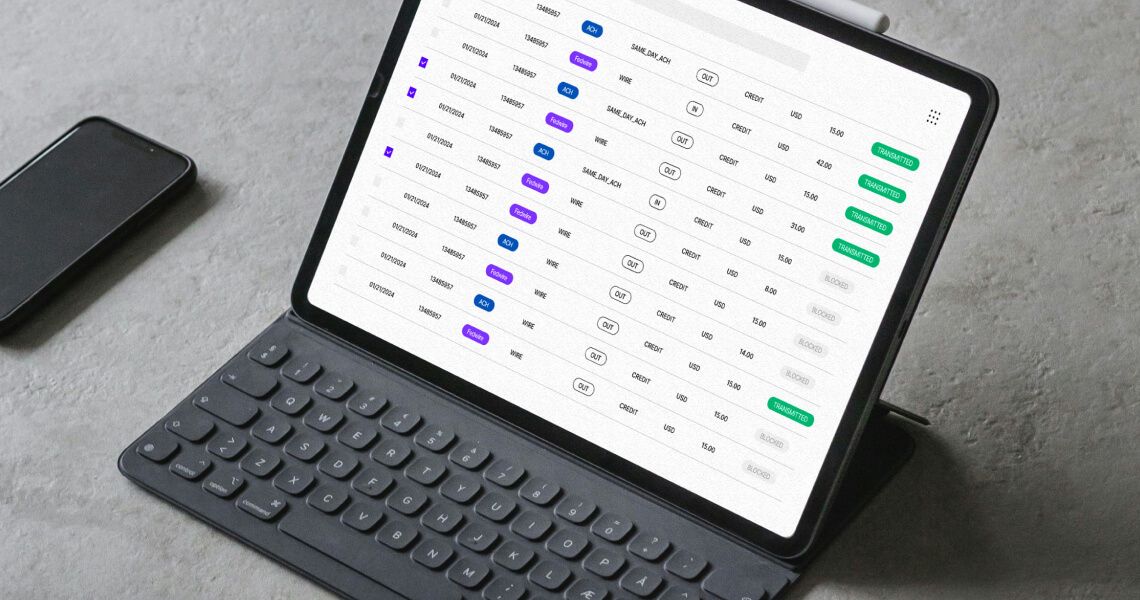

Seamlessly serve fintechs and enterprises with virtual accounts

24/7 virtual ledgers for immediate and transparent record-keeping

Use virtual accounts for direct control and visibility over fintech FBO custodial deposit accounts for BaaS partnerships. Help enterprises manage complex accounting structures. Easily integrate these solutions through APIs for an improved embedded banking experience.

Learn more about the power of virtual accounts from our report with Datos Insights.

Benefits you can bank on

Complete internal control

100% visibility of transactions with real-time GAAP and IFRS‑compliant accounting for fintech beneficial accounts.

FDIC rule compliant

FDIC-compliant accounting, recordkeeping, reporting and reconciliation processes for regulatory adherence, risk management and transparency.

Reduce cost

Manage accounts at scale beyond the core system through virtual accounts with more flexibility and less cost.

Increase revenue through embedded banking APIs

Use virtual ledgers to streamline accounts receivable (AR) and accounts payable (AP) management, attracting corporate customers.

Automated 24/7 real-time accounting

Get event‑driven, real‑time, rule‑based accounting integrated with general ledgers for all your channels.

Real‑time account alerts

Get event‑based customer notifications for ledger‑related activities – and stay in the loop with real‑time updates.

Multi‑currency and multi‑asset accounts

Give your customers the freedom to manage multiple currencies and multiple assets using virtual accounts.

Branded virtual card issuance

Issue white‑labeled debit cards for virtual accounts extending your ledger-as-a-service offerings.

Compliance reporting

Out of the box reports on custodial deposit accounts and transactions at beneficial owner level to meet FDIC rules.

Open APIs for embedded banking

Plug‑and‑play APIs for payments including FedNow, RTP, ACH and Fedwire, deposits, virtual accounts, FX, and more — all from a single integration.

Zero core downtime: enabling seamless 24/7 payments

Say goodbye to core downtime concerns with virtual ledgers that serve as a shadow core, guaranteeing seamless 24/7 instant payments on FedNow and RTP with flawless accounting.

Insights

6 CFPB Rules Financial Institutions Must Know for BaaS and Open Banking

Why Virtual Accounts Are Back in Vogue

Finzly Launches Account Galaxy: Embedded Banking Solution with Virtual Account and Virtual Ledger Capabilities

Datos Report: Virtual Ledgers — A Powerful Tool for Managing Fintech Relationships

Webinar On Demand – Embedded Banking with Brett King

Embedded Finance: Should Banks Overthrow Intermediaries and Reclaim Control?