Modernize Trade Finance. Maximize global growth.

Digitize and automate the full lifecycle of trade finance—commercial LCs, standby LCs, and documentary collections—all from a single, unified platform.

Digitize your trade financing processes with Finzly to accelerate revenue growth. Reduce manual workflows, cut turnaround times, and improve efficiency through back-office automation, enhancing customer experience and driving profitability and growth for your bank.

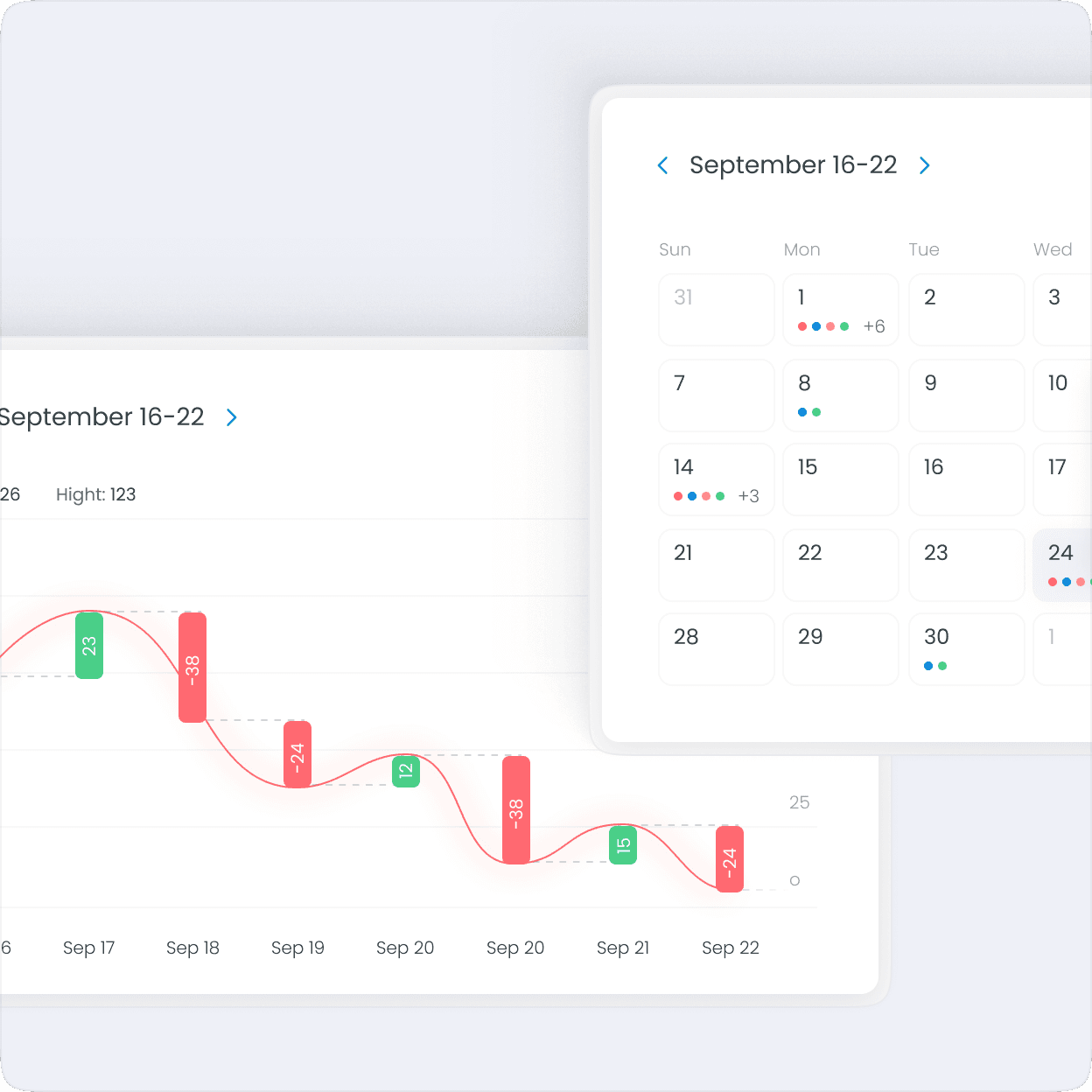

Modern trade finance experience

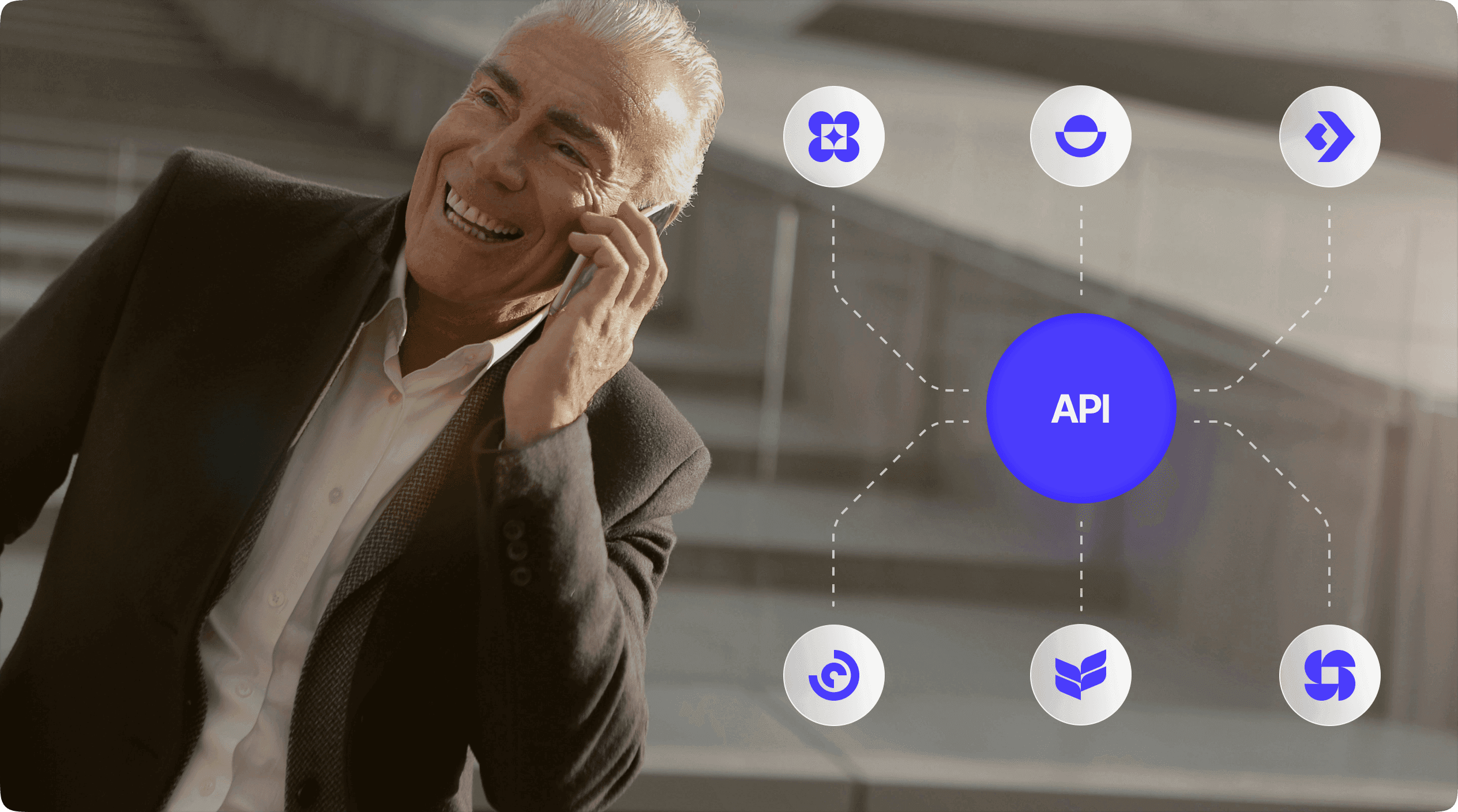

Centralized payment integration

Discrepancy and exception management

Automated end-of-day (EOD) processing:

Comprehensive accounting and compliance

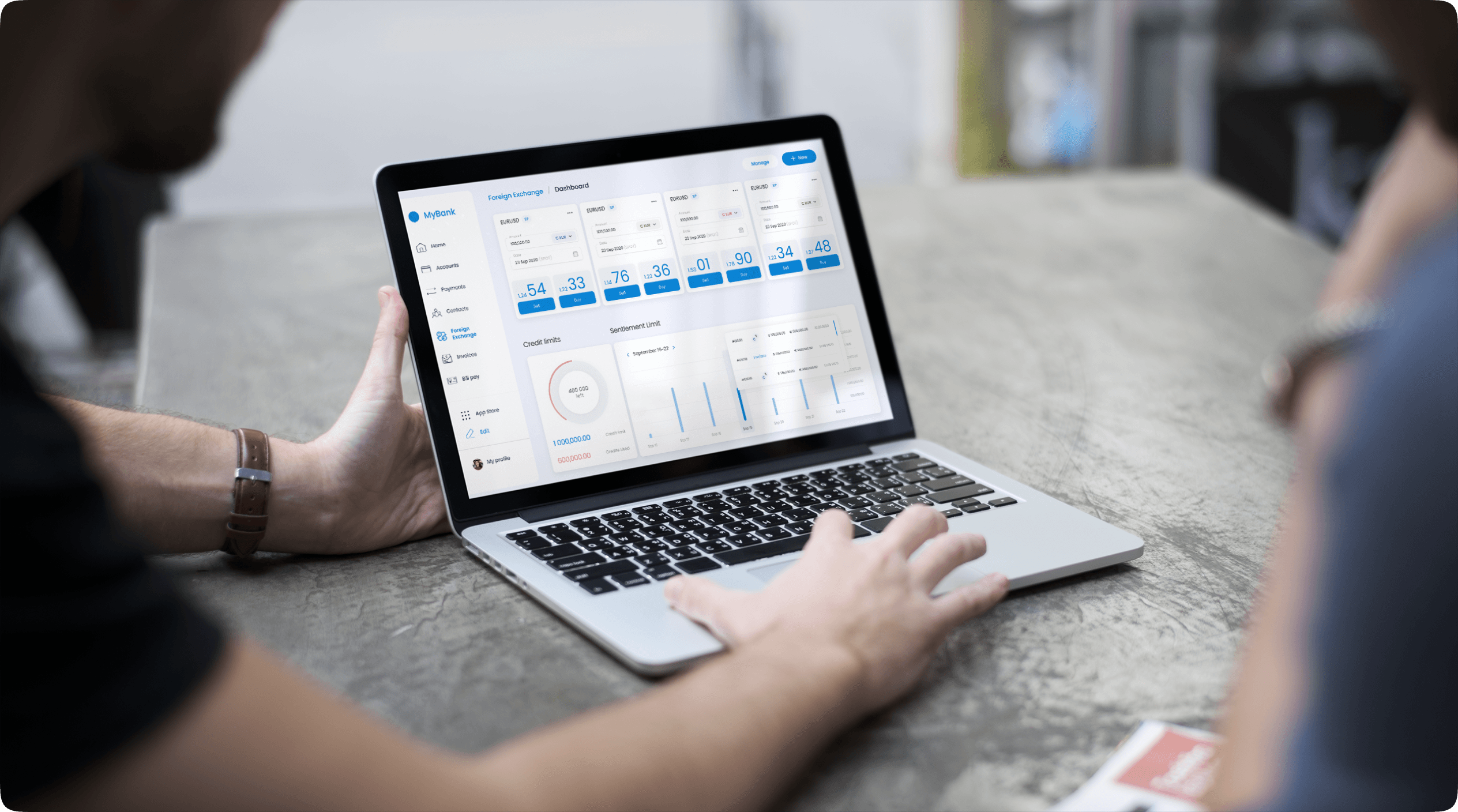

Trade, pay, manage — all in one place

Streamline trade finance, foreign exchange, and payments into one modern experience for your business clients.

Speak with an expertHow Synovus transformed global trade finance See how Synovus uses Finzly to deliver award-winning FX and trade services through a unified digital experience.

Have any

questions?

Everything you need to know