Real-Time Payments (RTP®) with Finzly

Enable 24/7 instant payments with certified RTP® connectivity—powered by a modern, ISO 20022-native platform.

Finzly’s RTP® solution gives financial institutions a future-ready path to real-time money movement. With lightning-fast APIs, certified TCH connectivity, and unmatched operational control, you can deliver secure, instant payments across any channel—without waiting on your core or reworking your infrastructure.

Multichannel initiation

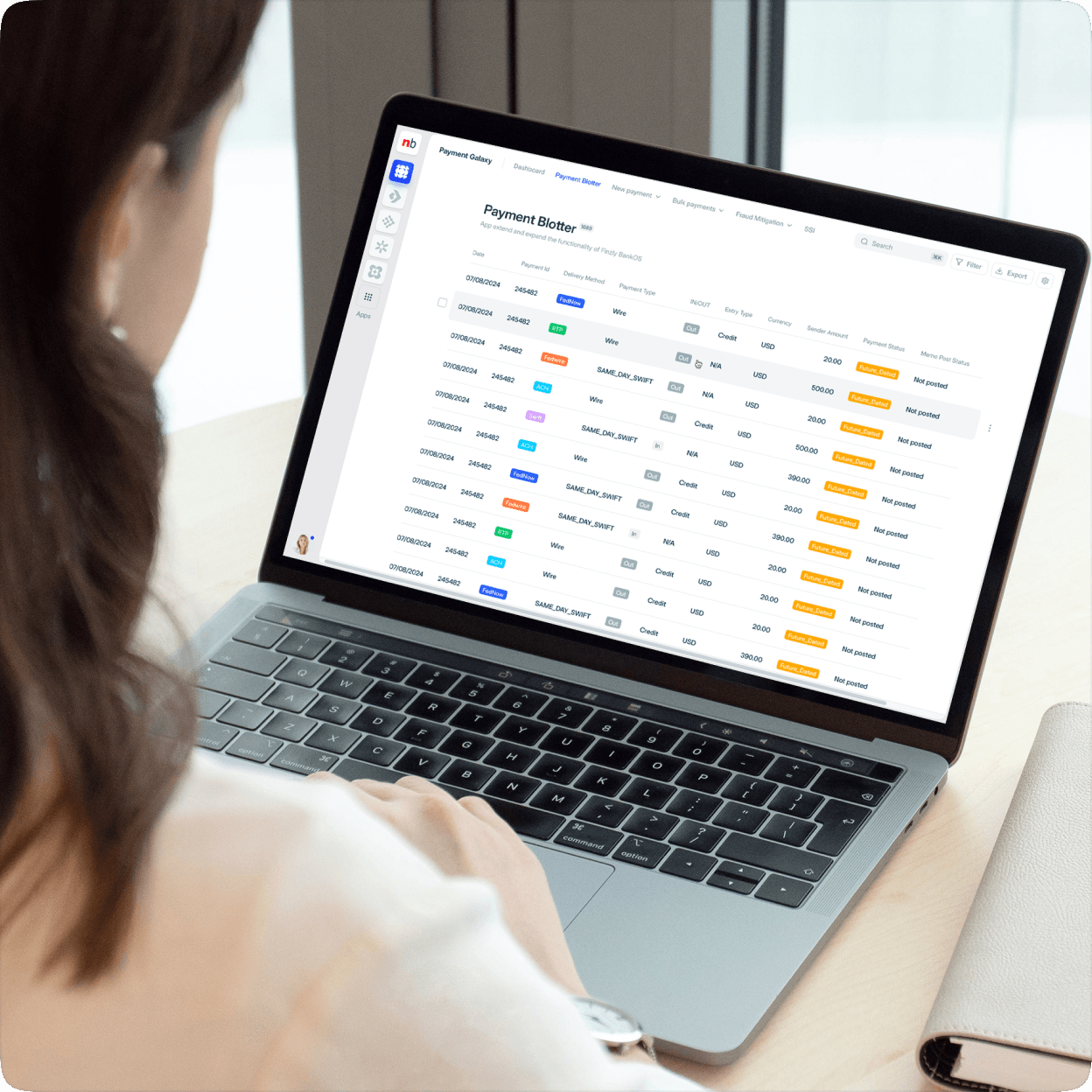

Real-time back-office visibility

Integrated fraud protection

Smart routing & resiliency

Blazing-fast throughput

Core-ready integration

Certified RTP connectivity

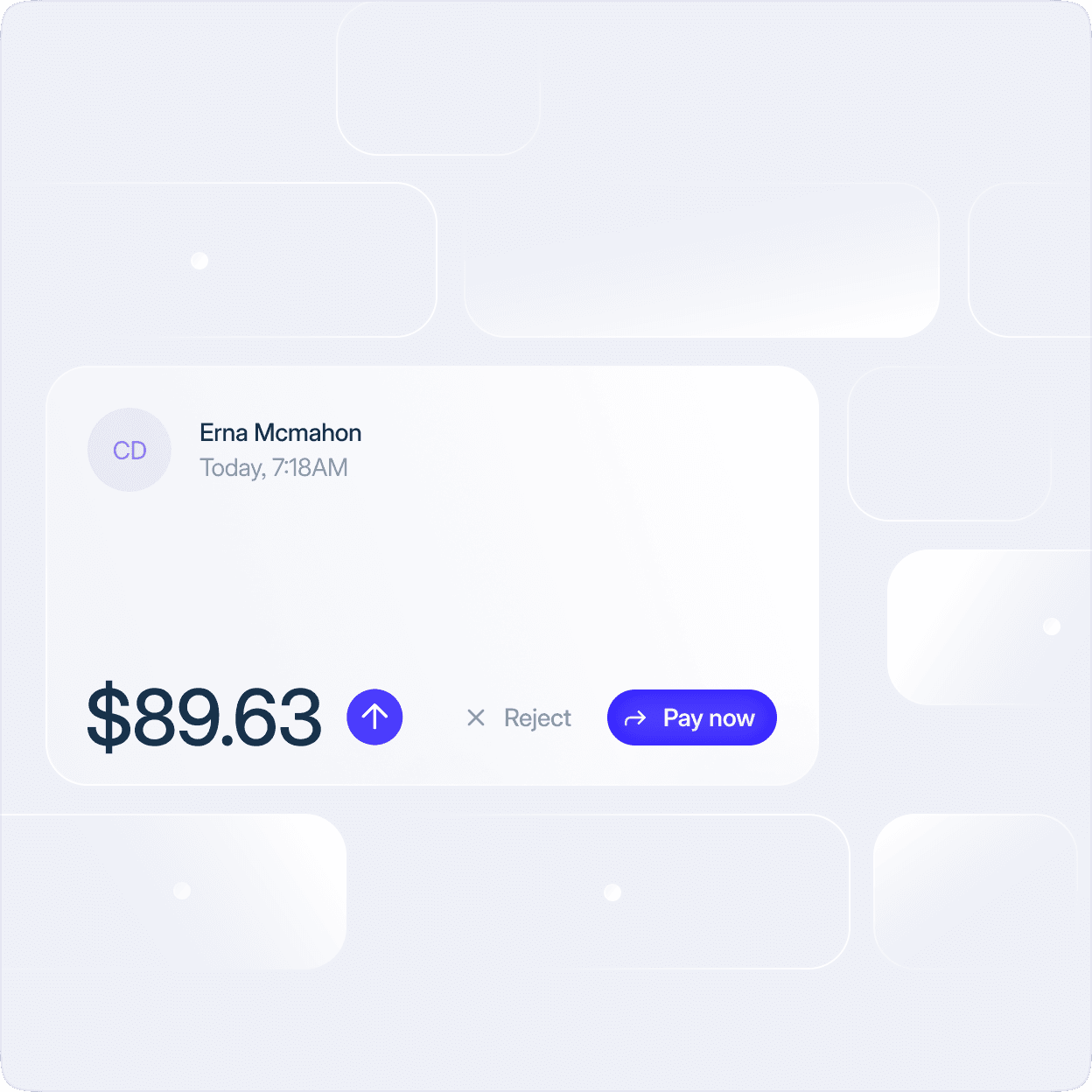

Deliver instant send, receive, and request

Stand out with a full RTP experience that enables every transaction type across every channel—backed by a flexible, secure platform.

Speak with an expertUnify your real-time strategy

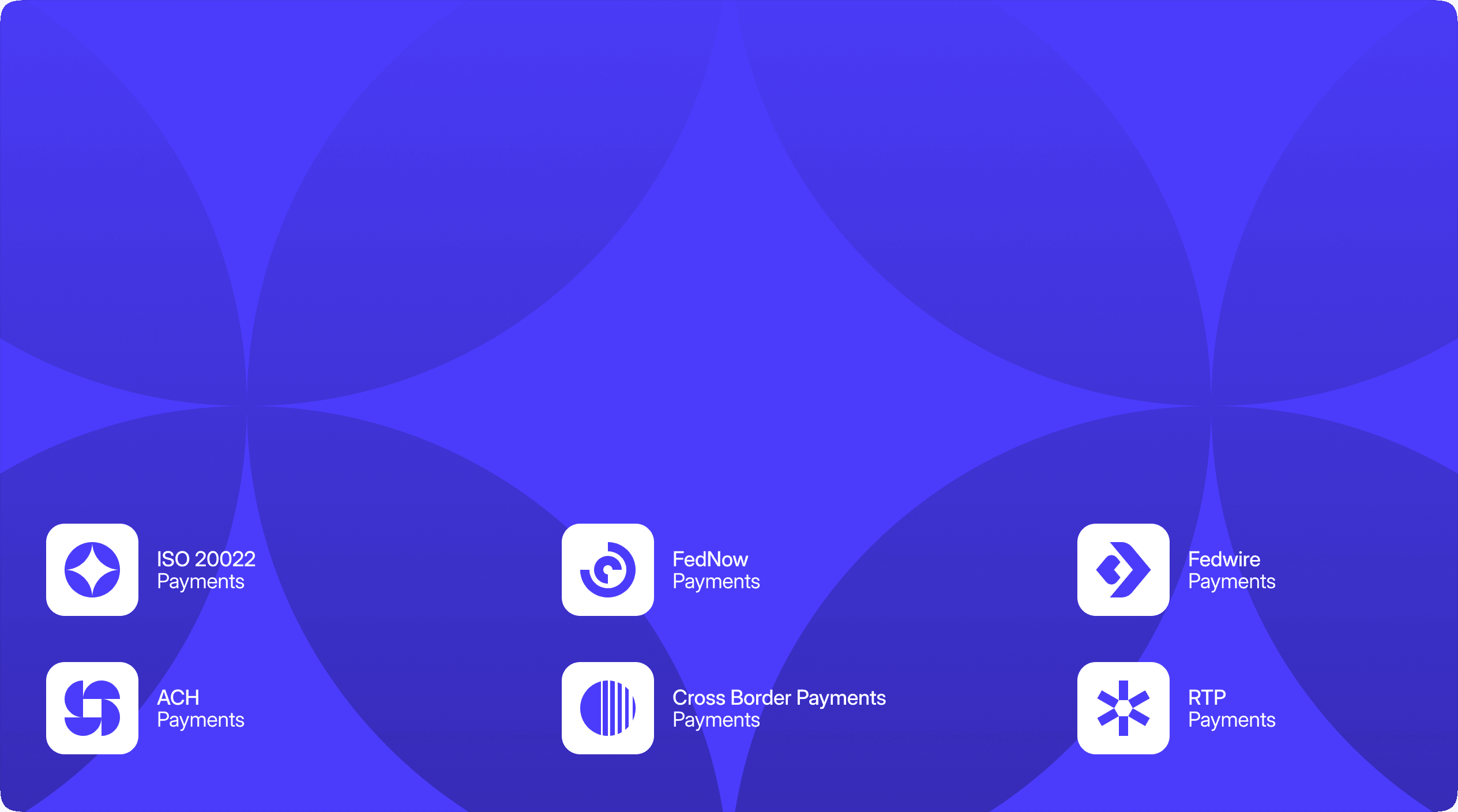

Manage RTP and FedNow on one platform with centralized controls, smart routing, and rapid deployment.

Learn more

Have any

questions?

Everything you need to know