Modern business banking that flexes with your customer

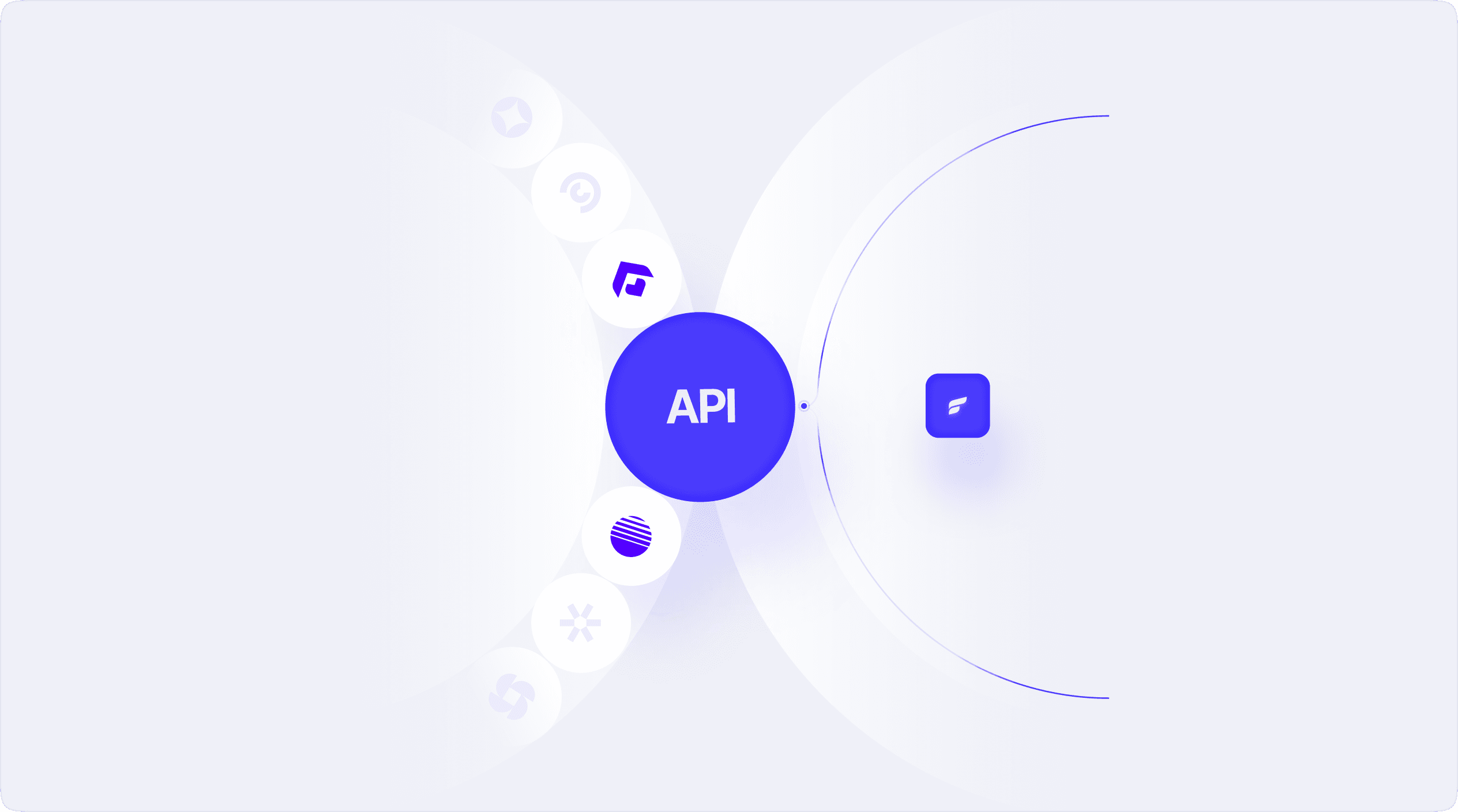

Deliver tailored, award-winning business banking experiences that adapt to every customer segment. Our flexible, API-first platform integrates directly into your digital banking experience—giving your clients powerful tools without the complexity. Get FedNow and RTP instant payment capabilities out of the box—no waiting for your digital banking provider.

Your business customers don’t want one-size-fits-all banking. With Finzly, you can deliver configurable, intelligent experiences, standalone or embedded into your digital banking systems, tailored to any business vertical - from startups to enterprise clients. Simplify account management, payments, and cash positioning—all in one modern interface.

Unified deposit management

Bulk payments, simplified

Granular user control

Multicurrency made simple

Actionable dashboards

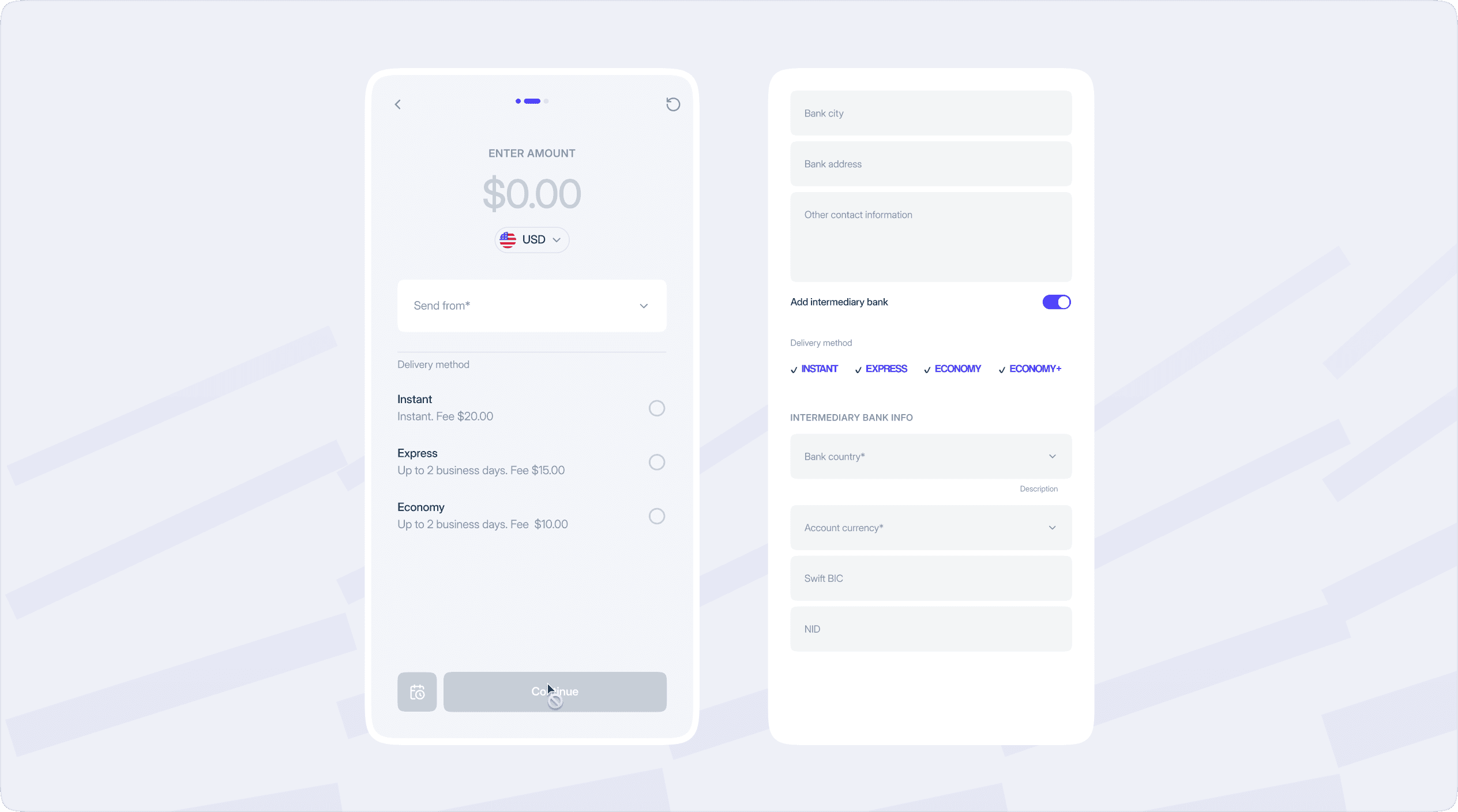

Flexible payment initiation

Enterprise-grade security

Effortless account switching

Modernize the way your customers manage payments

Simplify banking with Digital Galaxy’s smart chatbot—send, receive, and request payments with easy commands.

See how it worksDifferentiate with a Modern Request for Payment Experience

Offer a faster, more intuitive way to get paid—seamlessly integrated across all payment rails and embedded within your customers’ account workflows. under one seamless interface.

Speak with a payment expert

Have any

questions?

Everything you need to know