Modern ACH Payment processing, made for growth

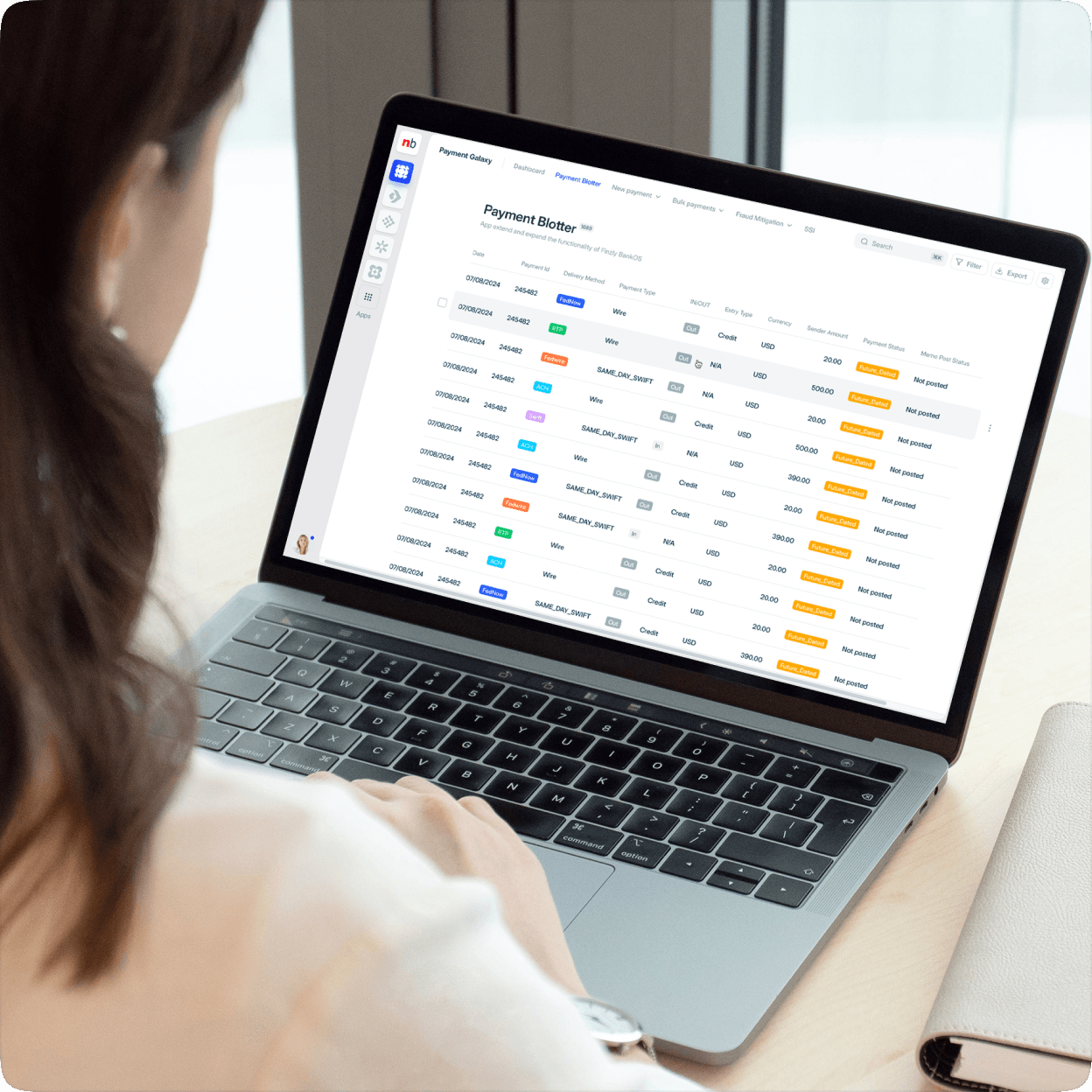

Simple, secure, scalable ACH processing— with real-time visibility, API-first design, automated risk controls, and cloud-native scale that meets upcoming compliance head-on.

Legacy mainframes and siloed tools weren’t built for today’s payment landscape. Finzly’s cloud-native ACH platform delivers built-in fraud detection, account validation tools, and real-time controls to meet NACHA’s new rules—while scaling volume, embedding ACH in partner ecosystems, and delivering a better customer experience

High-volume ACH processing

Proactive fraud and account validation

Built-in risk mitigation

Modern business UX

ACH APIs for embedded use cases

Automated pre-funding for faster ACH settlements

Smart cash management

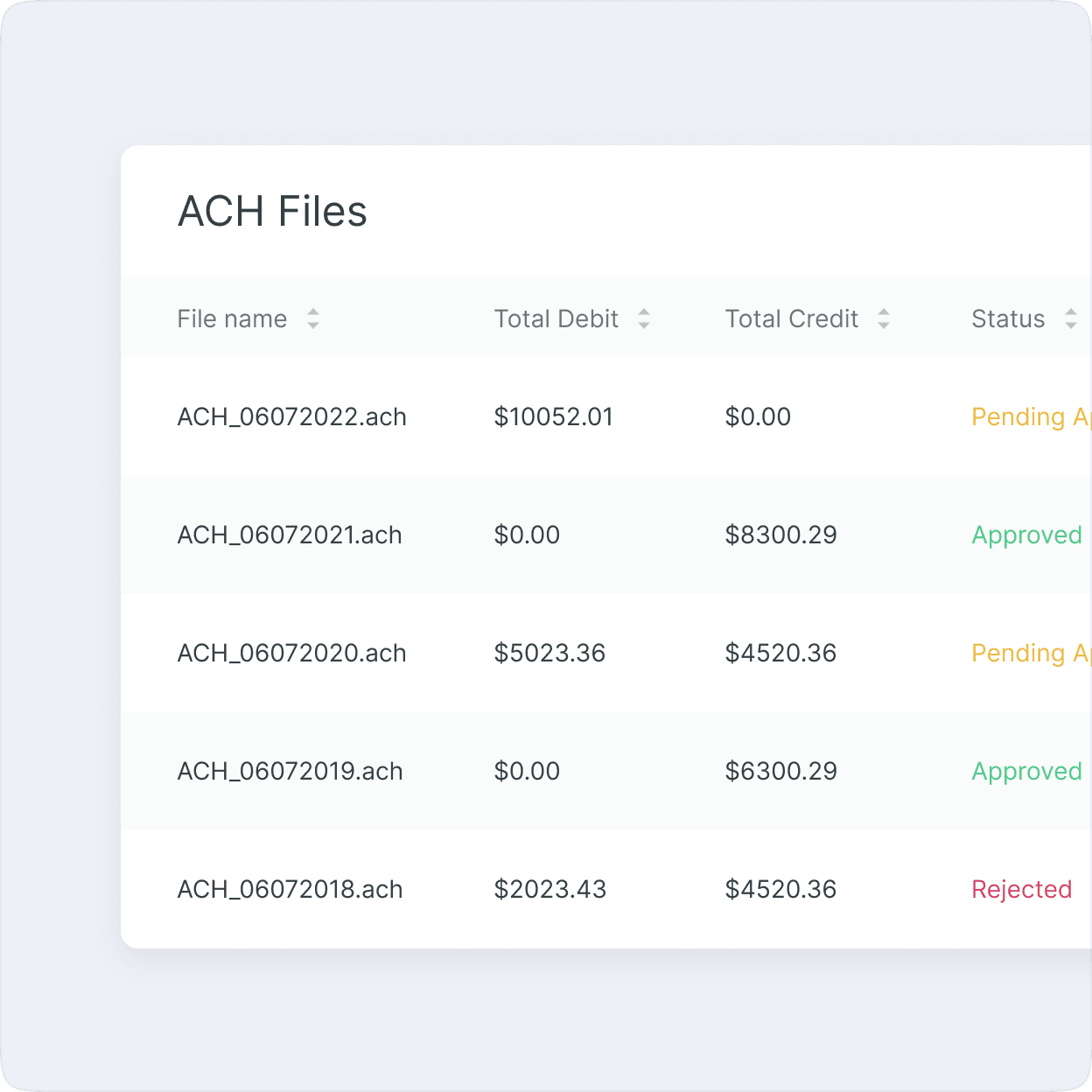

Unified ACH platform; no silos, no manual work

Finzly consolidates initiation, receipt, and settlement into a single, composable ACH solution built for scale.

Learn moreSurround & shrink your legacy ACH platform Don’t rip and replace—wrap your existing core with Finzly’s modern ACH capabilities. Gradually migrate functions without disruption, while gaining automation, API access, and real-time control.

Have any

questions?

Everything you need to know