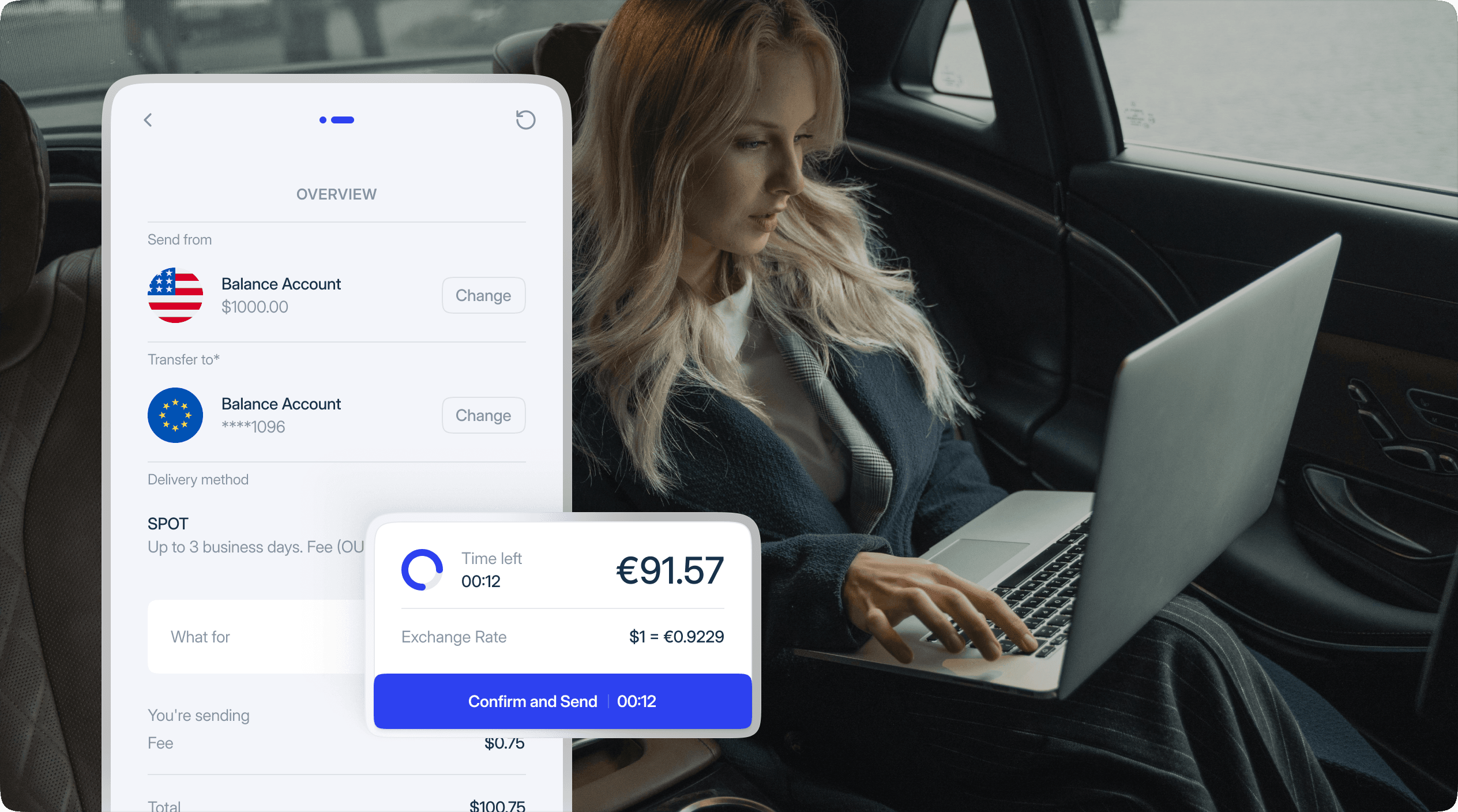

International payment —without building, waiting, or relying on others

Deliver fast, transparent, and profitable international payments through your own rails. No dependency on fintechs. No correspondent middlemen. Just full control, better revenue, and a modern experience for your customers.

Finzly makes it easy for banks of any size to offer international payments like the biggest players. From pre-connected liquidity providers and live FX to real-time visibility and smart compliance, everything you need is built in—so you can go to market fast, retain more customers, and improve margins.

Pre-connected FX & SWIFT ecosystem

Real-time FX with full pricing control

Go live in weeks, not quarters

Real-time visibility into every payment

Built-in global compliance & validation

Advanced treasury & risk controls

Keep retail customers in-house

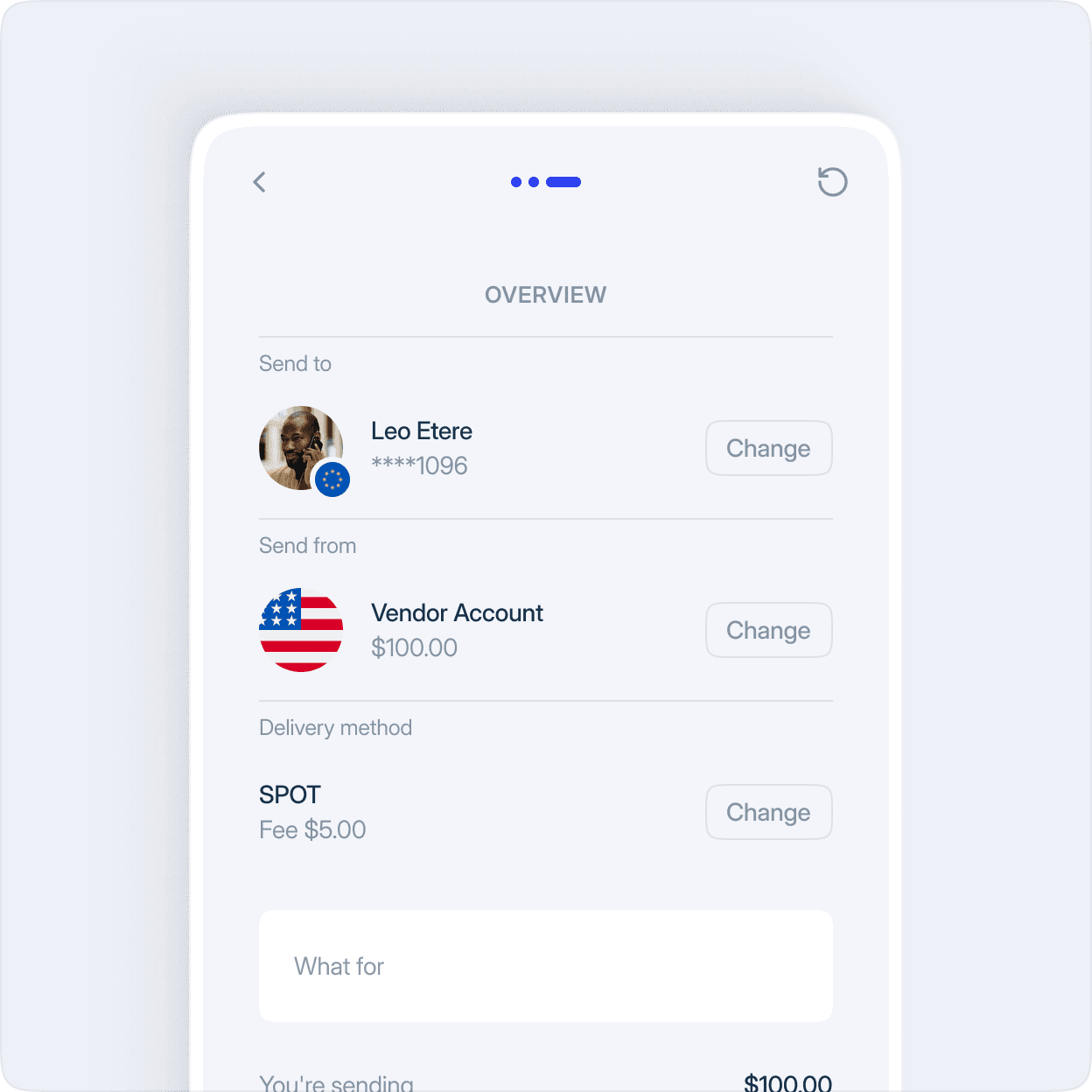

Take back control of cross-border revenue

Finzly helps you stop revenue leakage to correspondent banks and fintechs. Own your FX margins, eliminate intermediaries, and deliver faster, more transparent international payments—while staying fully compliant. More margin. More loyalty. Less risk.

Learn moreA turnkey international banking core with a fully pre-wired ecosystem

Skip the heavy lift. Launch SWIFT MX-ready international payments with a ready-to-go core built for cross-border scale. Launch international payments faster—without building from scratch or juggling vendors. Finzly’s modern core comes pre-integrated with real-time FX providers, liquidity partners, SWIFT, compliance engines, and digital banking platforms like Backbase, Alkami, and Q2. No need to build. No need to stitch together vendors. Just plug in and go live.

Speak with an expert

Have any

questions?

Everything you need to know