One account. Every currency. Global growth made simple.

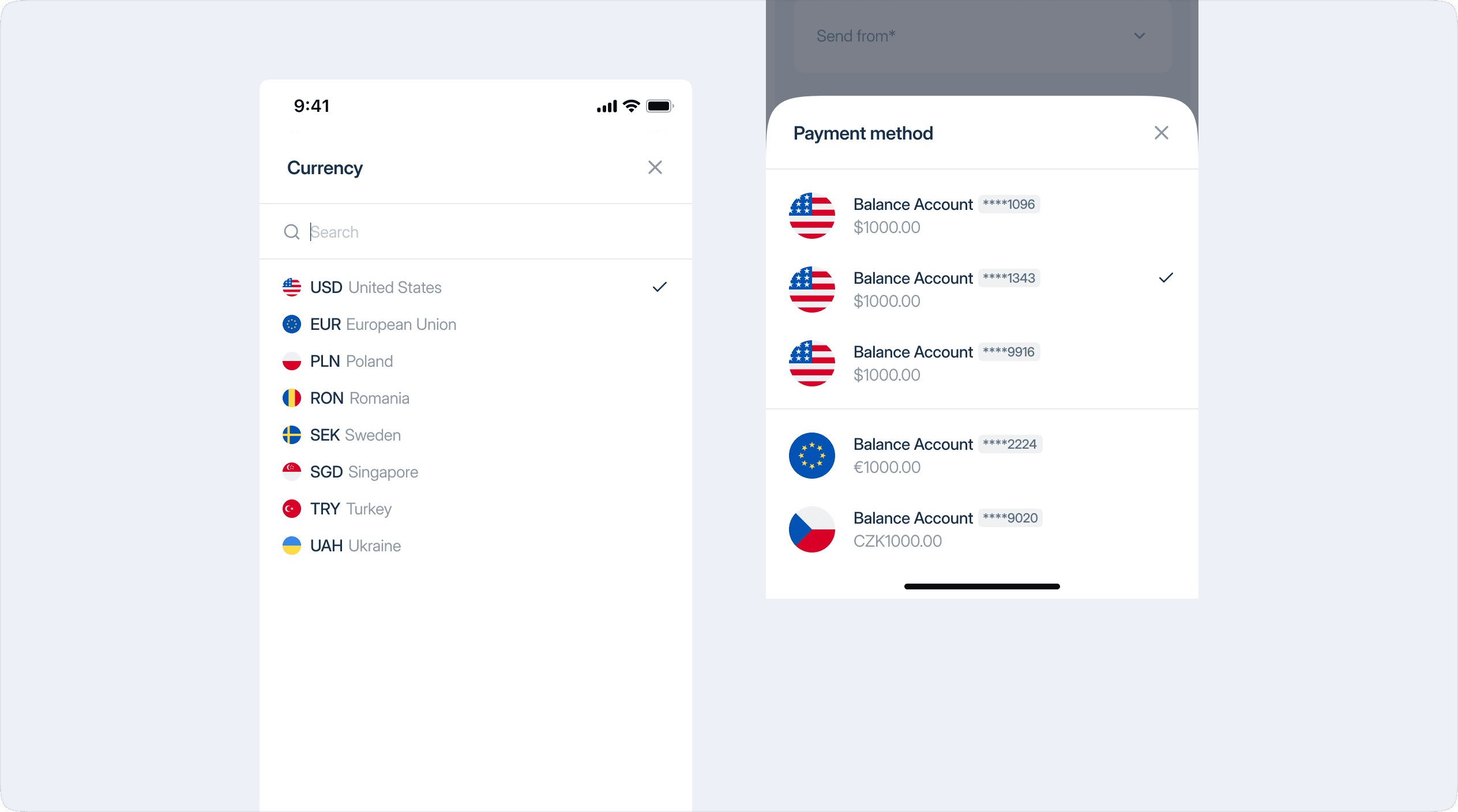

Empower customers to hold, convert, and transact in multiple currencies—all from a single account, fully integrated with your payments ecosystem.

Finzly’s multicurrency platform gives banks the power to deliver seamless cross-border banking without relying on correspondent banks or third-party fintechs. With easy connectivity to SWIFT rails, liquidity providers and native FX capabilities, your bank takes full control of the global payments experience.

Multi-currency, single account

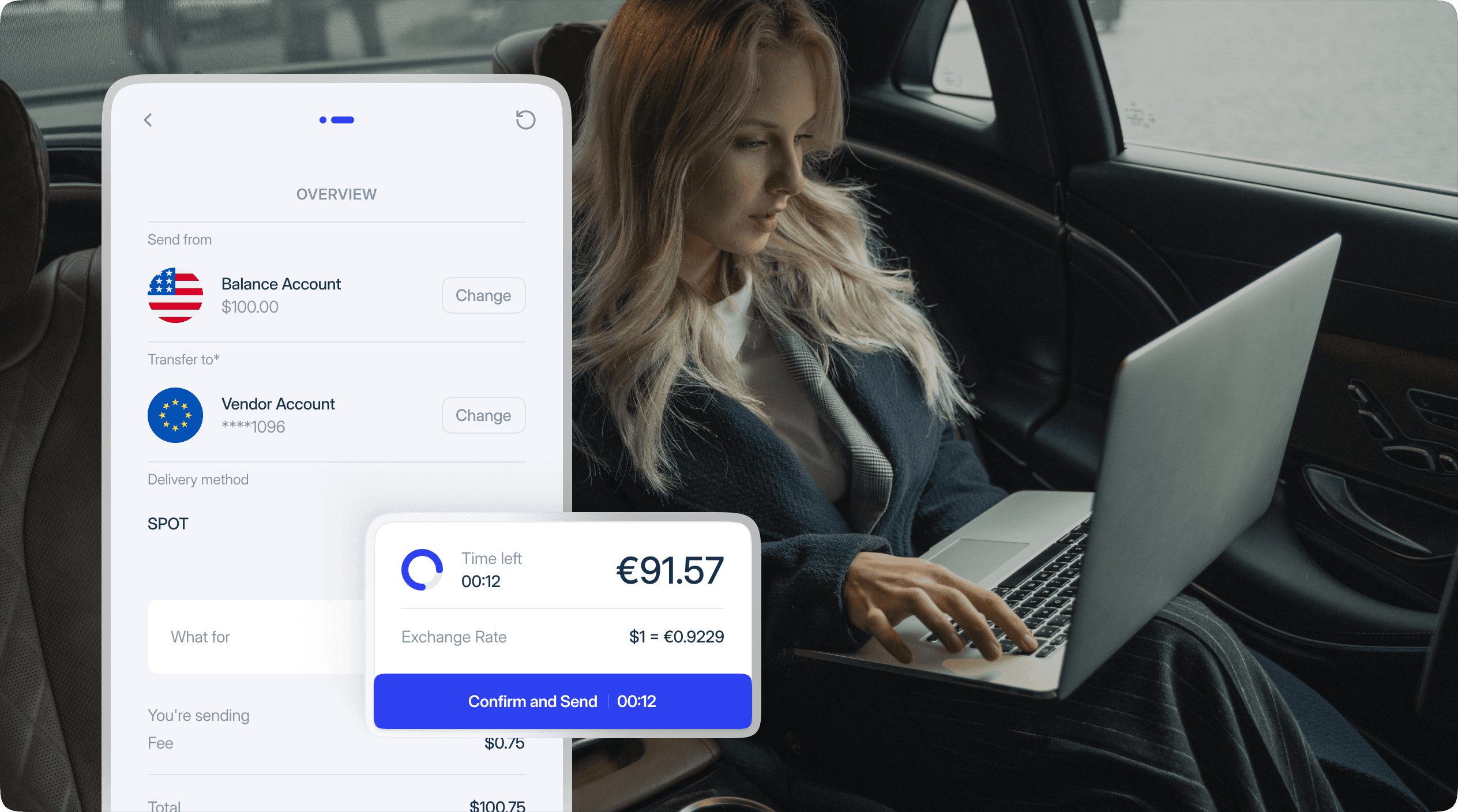

Instant FX conversion and settlement

Virtual account compatibility

Low-lift, high-impact implementation

Grow non-interest revenue

Launch multi-currency accounts without the complexity - in weeks!

Core-independent & API-ready, easily integrate MCAs into your digital channels and workflows without the burden of legacy systems.

Speak with an expert Have any

questions?

Everything you need to know