Go further, faster with Fedwire®

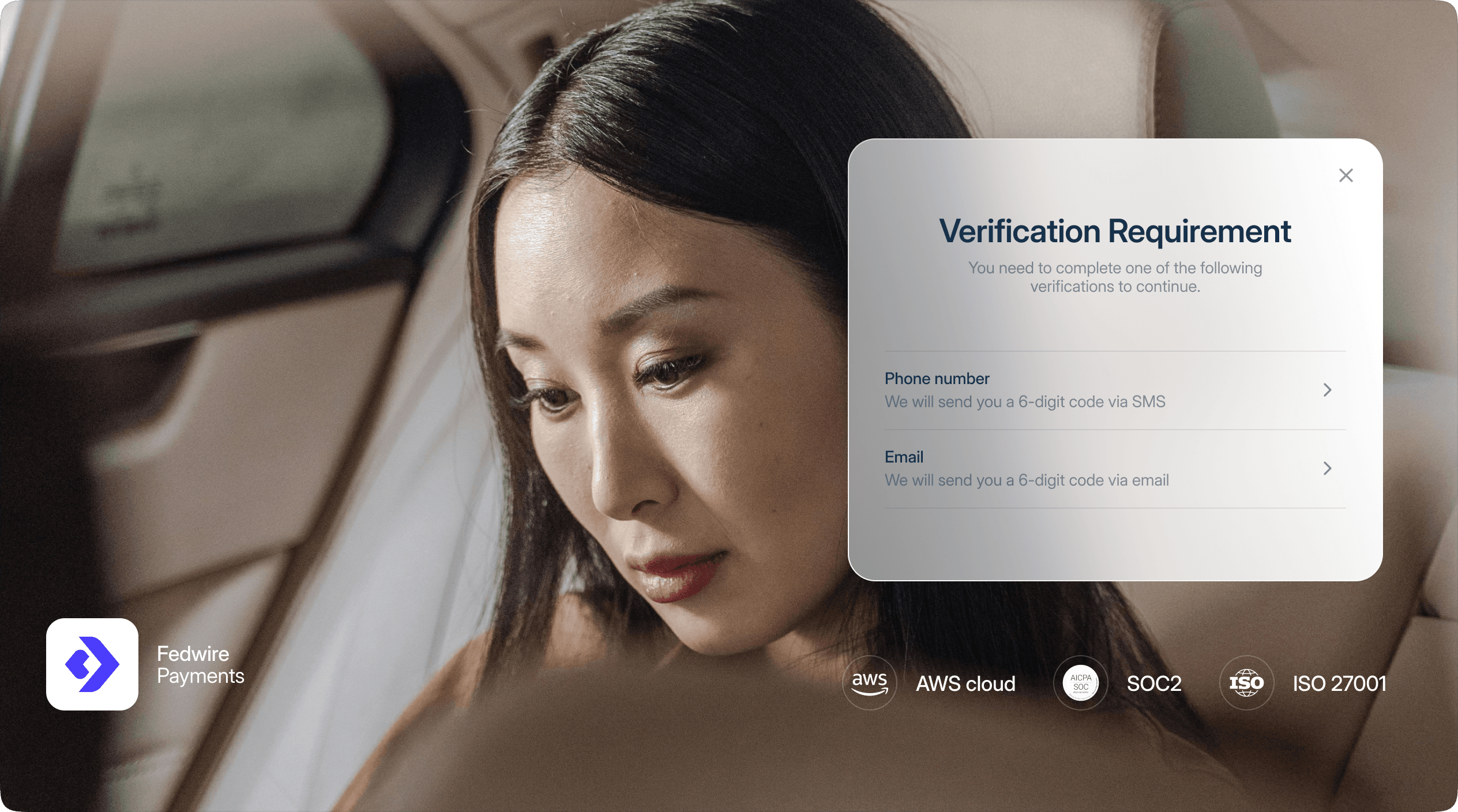

Modern, automated, ISO 20022-native Fedwire processing—built for speed, security, and scale.

Say goodbye to clunky, manual wire processing. Finzly delivers a secure, cloud-native wire platform with real-time execution, ISO 20022-native data richness, and easy integration. Accelerate settlements, enhance transparency, and serve high-value clients with confidence.

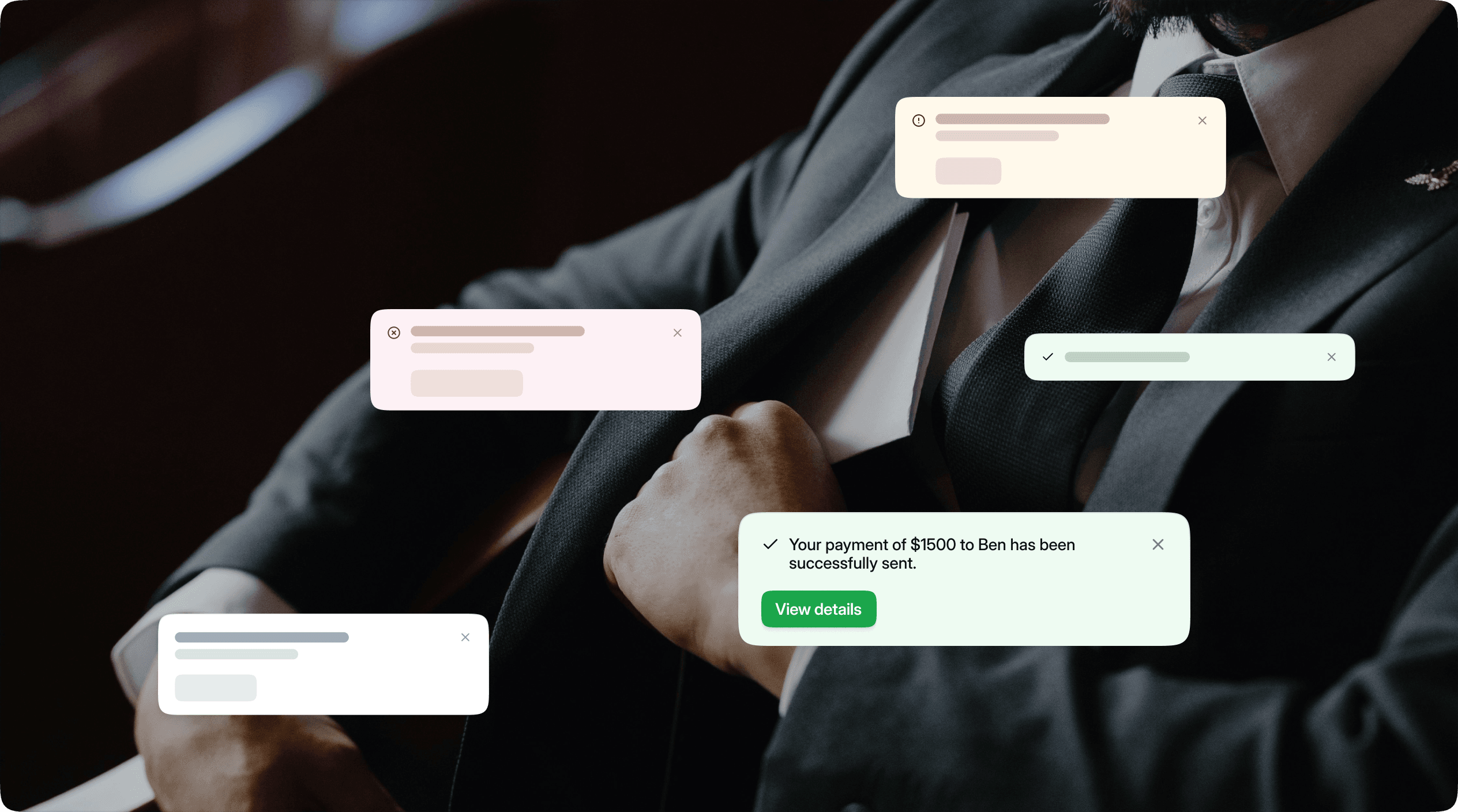

Modern wire payment experience

ISO 20022-native processing

Open APIs for embedded use cases

Multichannel transaction support

Fedwire sweeps for liquidity optimization

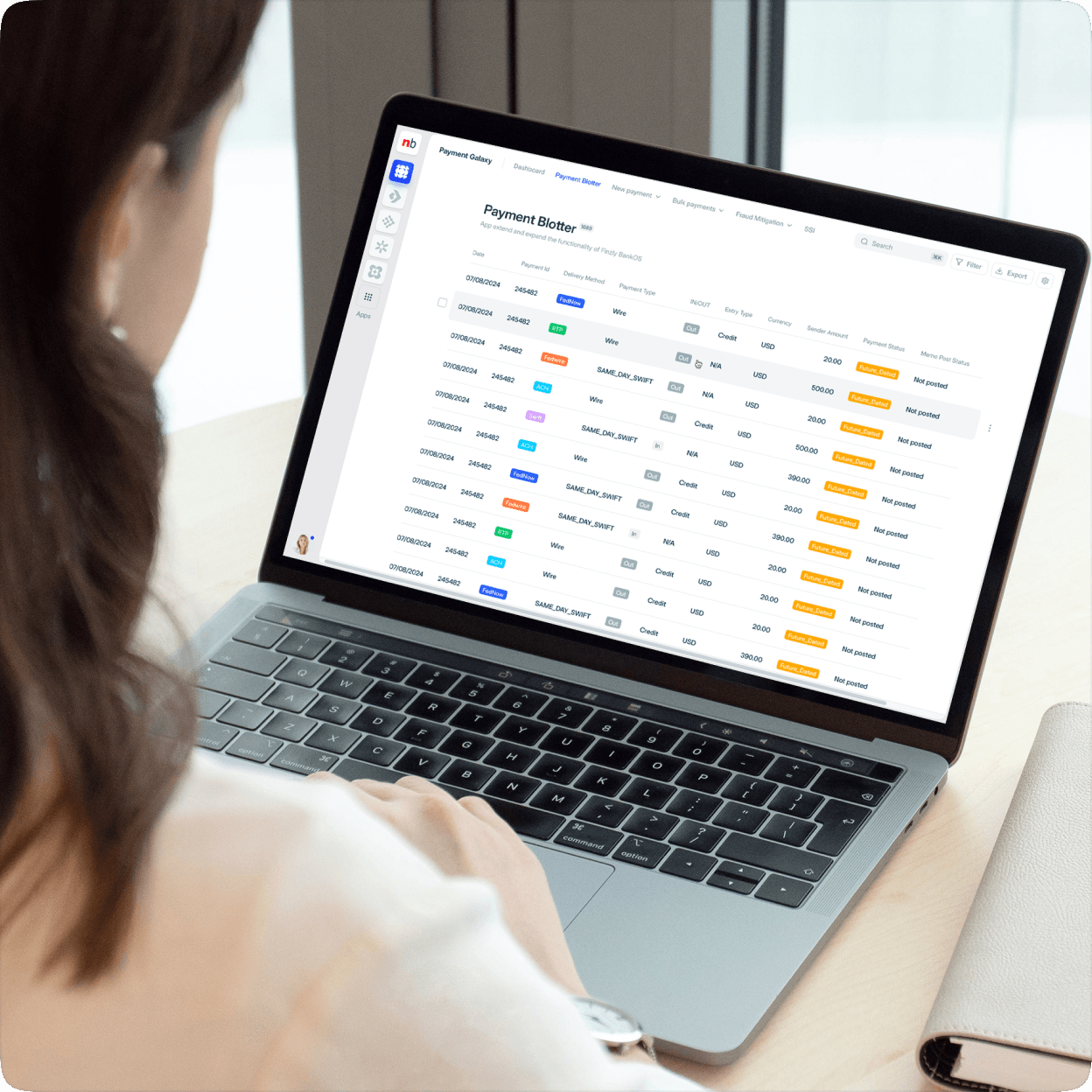

Process Fedwire payments in under 60 seconds

Composable workflows and automated STP bring wire processing time down to under a minute—with up to 100% straight-through processing.

Speak with an expertSurround & Shrink your legacy Fedwire

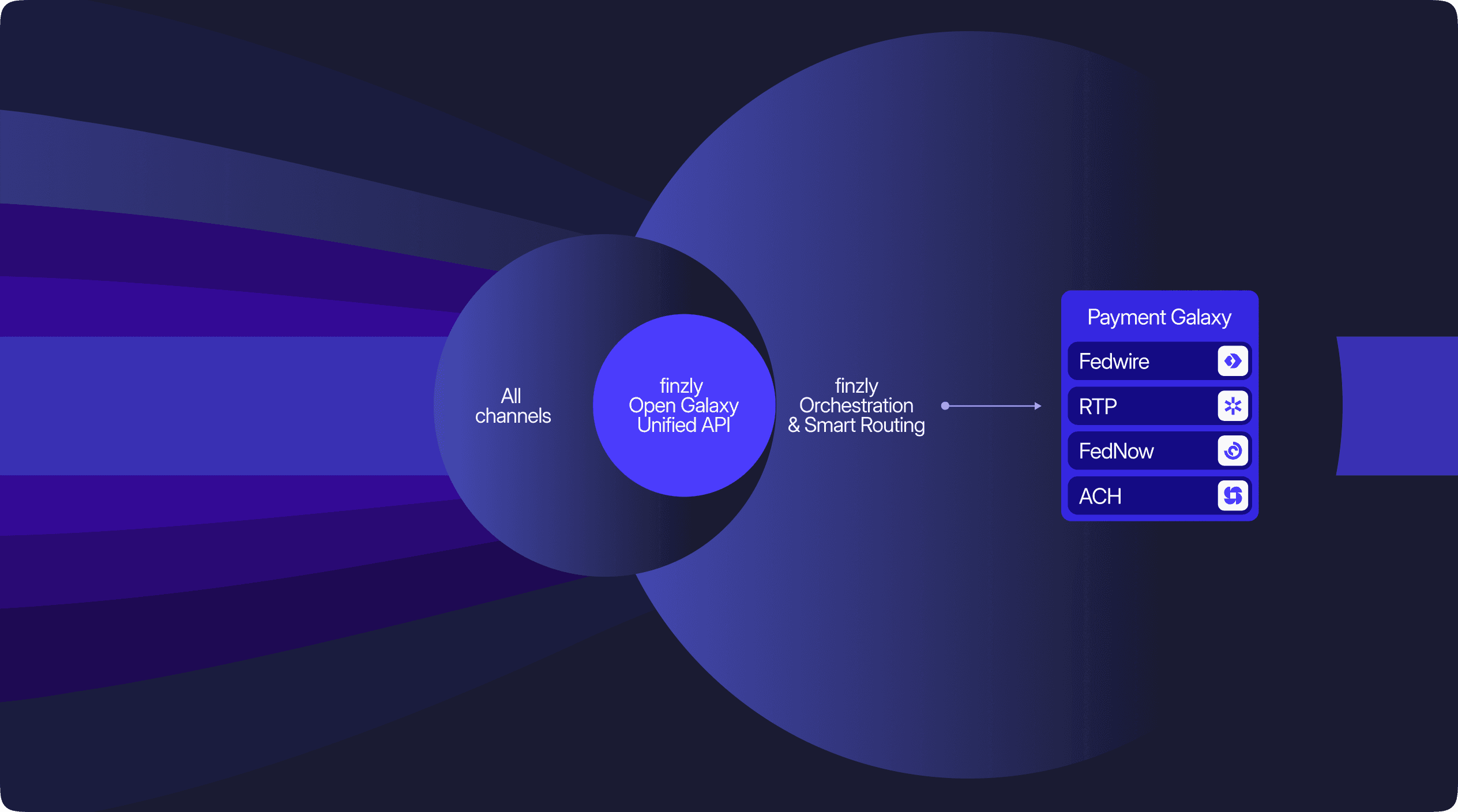

Modernize without disruption—centralize every rail in one unified hub. Break free from siloed systems by surrounding your legacy Fedwire setup with a proven, ISO 20022-native payment hub. Finzly connects Fedwire, ACH, RTP®, FedNow®, and SWIFT into a single platform—giving you full visibility, reduced overhead, and the confidence to shrink legacy systems at your pace, not theirs.

Learn more

Have any

questions?

Everything you need to know