FedNow® success in 8 weeks. Don’t get left behind.

Launch the full FedNow® and RTP® experience; send, receive, request for real-time payments outside your core. Proven, revenue-ready, and trusted by leading banks. The fastest, simplest, and most future-ready solution for financial institutions to connect to the FedNow® service.

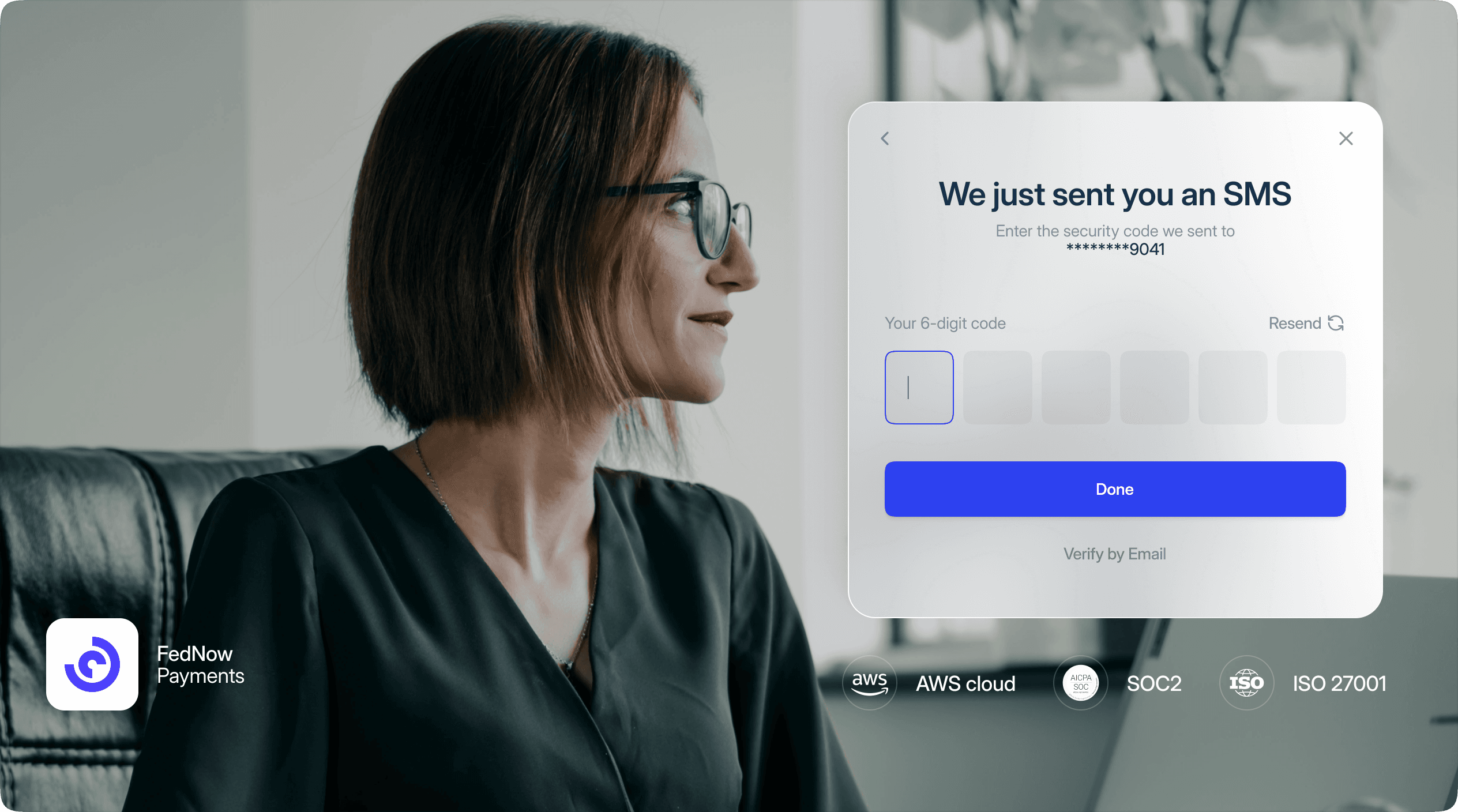

Finzly’s award-winning, core-independent FedNow® solution empowers financial institutions with real-time, 24/7/365 payments. From sending to receiving to requesting payments, our platform offers unmatched flexibility and speed—without the delays or overhead of traditional infrastructure.

Multichannel payment initiation

Back-office control and compliance

Integrated real-time fraud protection

Smart routing to other rails

High-speed transaction processing

Seamless integration with core systems

Certified, managed FedNow® connectivity

Built for revenue-driving use cases

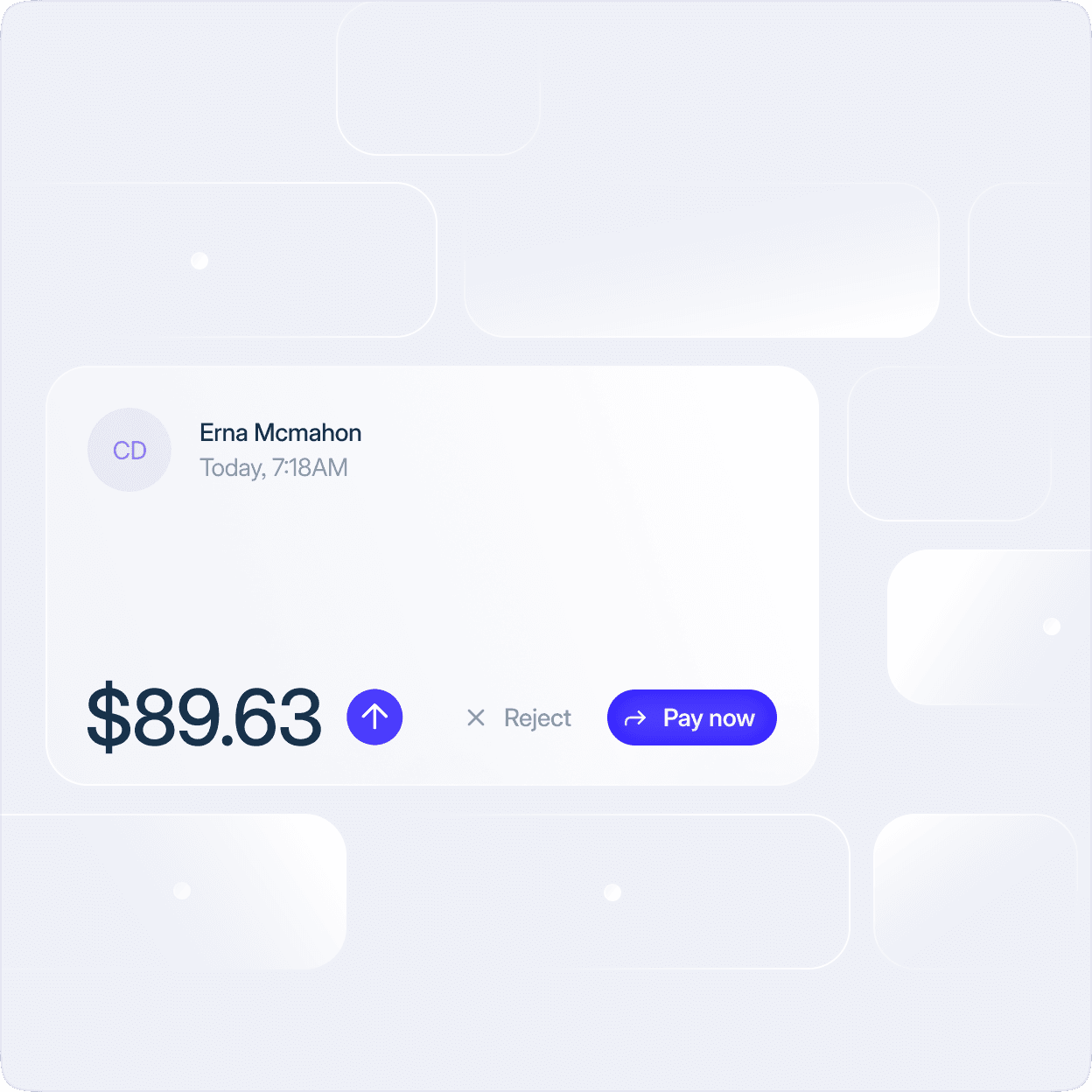

Finzly enables high-value, real-time payments through flexible APIs and intuitive digital experiences.

- Enables utility providers and lenders to initiate payment requests with ease and speed.

- ERP-connected supplier payments for corporate clients.

- Instant disbursements for title companies and insurers.

- Immediate tax refunds and government disbursements.

- Just-in-time payroll and treasury movement for SMBs

Deliver the full FedNow® experience

Offer more than just “Receive”. Most FedNow® providers stop at the minimum. Finzly gives you the complete package:

- Instant Send

- Real-time Receive

- Built-in Request-for-Payment (RfP)

Built on flexible APIs for revenue growth, with ready-to-use digital experiences that easily connect to your digital banking. Integrate easily with online and mobile banking, treasury portals, ERP/accounting platforms, fintechs, and embedded...

Learn more

Have any

questions?

Everything you need to know