Making money work for everyone

Money movement matters, and we’re obsessed with making it better

Helping financial institutions thrive with simple and futureproof money movement and banking, fit for the modern age

Our vision is to help you achieve yours—with innovative banking products that enable your business to thrive and improve your customers' lives. We’re committed to delivering the best technology to help financial institutions move money in a way that's designed for the modern economy, offering exceptional money movement experiences to bankers and their customers through simplified payment transformation powered by the latest technology.

Leadership team

Booshan Rengachari

Founder, CEO

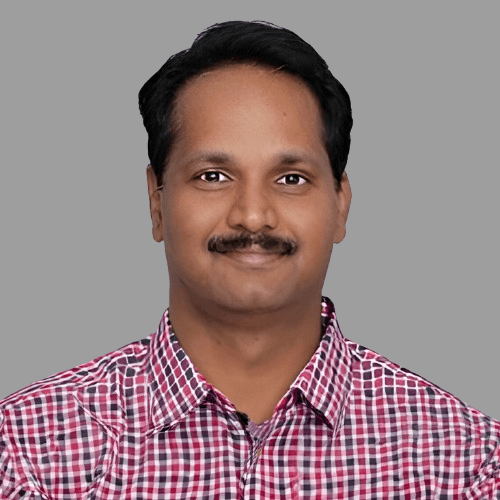

Murthy Balusu

Chief Information Officer

Aarthie Ramachandran

Chief Of Staff

Pat Szewczyk

Head of Global Trade & Product Delivery

Vijay Vardhan

Head of Payments

Karuna Kathir

Head of Sales

Kanan Ajmera

Head of Professional Services

Dean Nolan

Head of Payment Strategy

Robert Coakley

Head of Partnerships

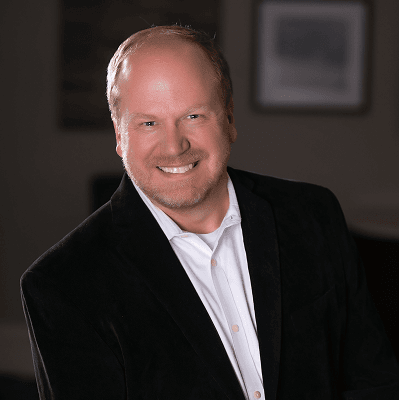

Marc Schroeder

Chief Marketing Officer

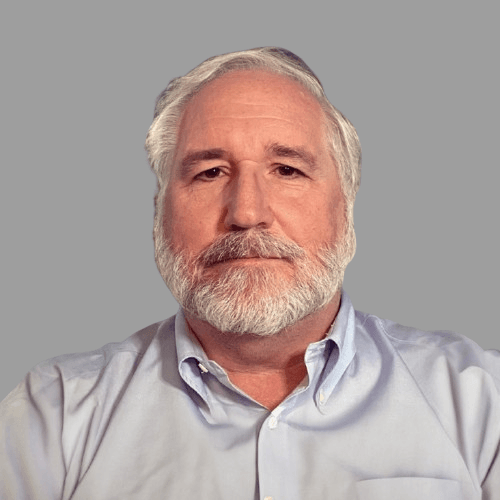

Steve Ledford

Executive Advisor

Gene Neyer

Executive Advisor

Inder Koul

Executive Advisor