Real‑time payments, on tap

A quicker way to click and pay

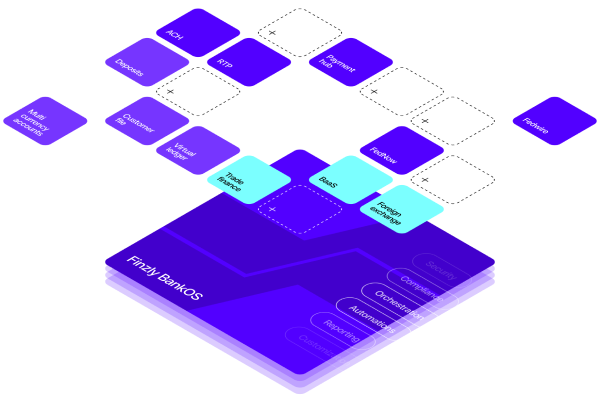

Consolidate initiation, processing and connectivity with advanced RTP payment capabilities. From origination to clearing, streamline the entire payment lifecycle. Outpace competitors with unrivaled speed and performance. All with flexible connectivity options to fit your existing infrastructure.

Benefits you can bank on

Go to market fast

Don’t wait for layered solutions from legacy core providers. Use our reliable pre‑wired, certified and tested connections and go to market faster.

Stay ahead

Use the SaaS platform that’s constantly updated to meet new standards, regulations, industry innovation and customer expectations.

Grow revenue

Join the forward-thinking institutions growing their revenue with outstanding customer experiences and value‑added services through APIs for embedded banking.

Multi-channel support

Send, request and receive real time payments 24/7, 365 days of the year through multiple channels – APIs, bulk files, digital banking and in-branch.

Seamless integration

Enjoy smooth onboarding with our ready‑to‑go RTP solution that integrates with your internal systems and your core.

Instant fraud protection

With integrated real‑time fraud monitoring and compliance to meet processing time constraints, it’s your first and last line of defense against fraud in instant payments.

Smart routing

Network outage? Processing bottleneck? Mitigate the risk of payment failures or delays by automatically rerouting transactions to other rails.

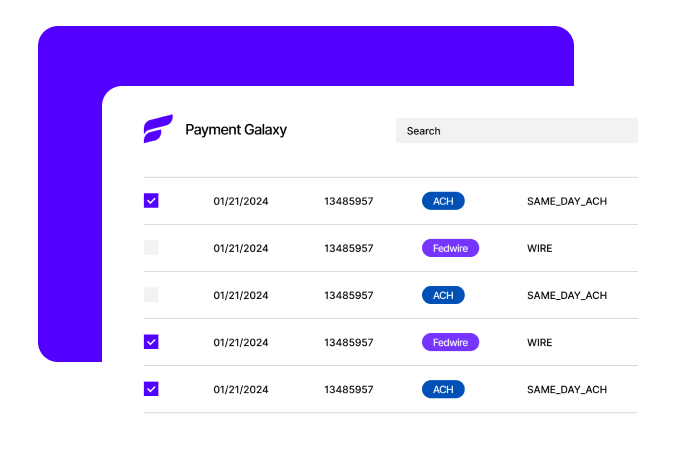

Finzly Payment Hub

Manage all payment rails in a modern, unified experience.

Smoother, smarter, faster payment experience

Give your customers the joy of secure, instant payments that settle within seconds. And keep them in the loop with real‑time updates on their payment status. Start with receiving payments, then add the functionality of sending payments when the time’s right.

Powered by a scalable, real‑time, 24/7, resilient architecture

Insights

Finzly Announces its Stablecoin and Tokenized Deposits Strategy for Its API-First, Multi-Rail Payment Platform

American Banker Webinar On Demand: What Bankers Really Think About Stablecoins – And Why It Matters Now

FedNow® at Two: “Astounding” Growth with Plenty of Room to Grow

Stablecoins: Exploring the Future of Cross-Border Payments

Finzly Appoints First Chief Financial Officer and Head of Partnerships to Accelerate Growth and Expand Market Reach