The all‑encompassing payment hub for financial institutions

A next‑gen, end‑to‑end payment hub for every rail

Leave siloed payment systems in the past. It’s time for a more connected future. Finzly’s payment hub brings all payment rails together into one system or simplifies your existing systems through payment orchestration. Plus, it increases straight‑through processing (STP) by up to 100%.

Increase efficiency

With all your payment rails in one place, you’ll eliminate the need to manage disparate teams and systems.

Reduce costs

Minimize the expense of a fragmented payment infrastructure. Maximize returns with less overheads and more productivity.

Boost revenue

Attract customers and unlock new revenue streams with the industry’s most innovative payment features

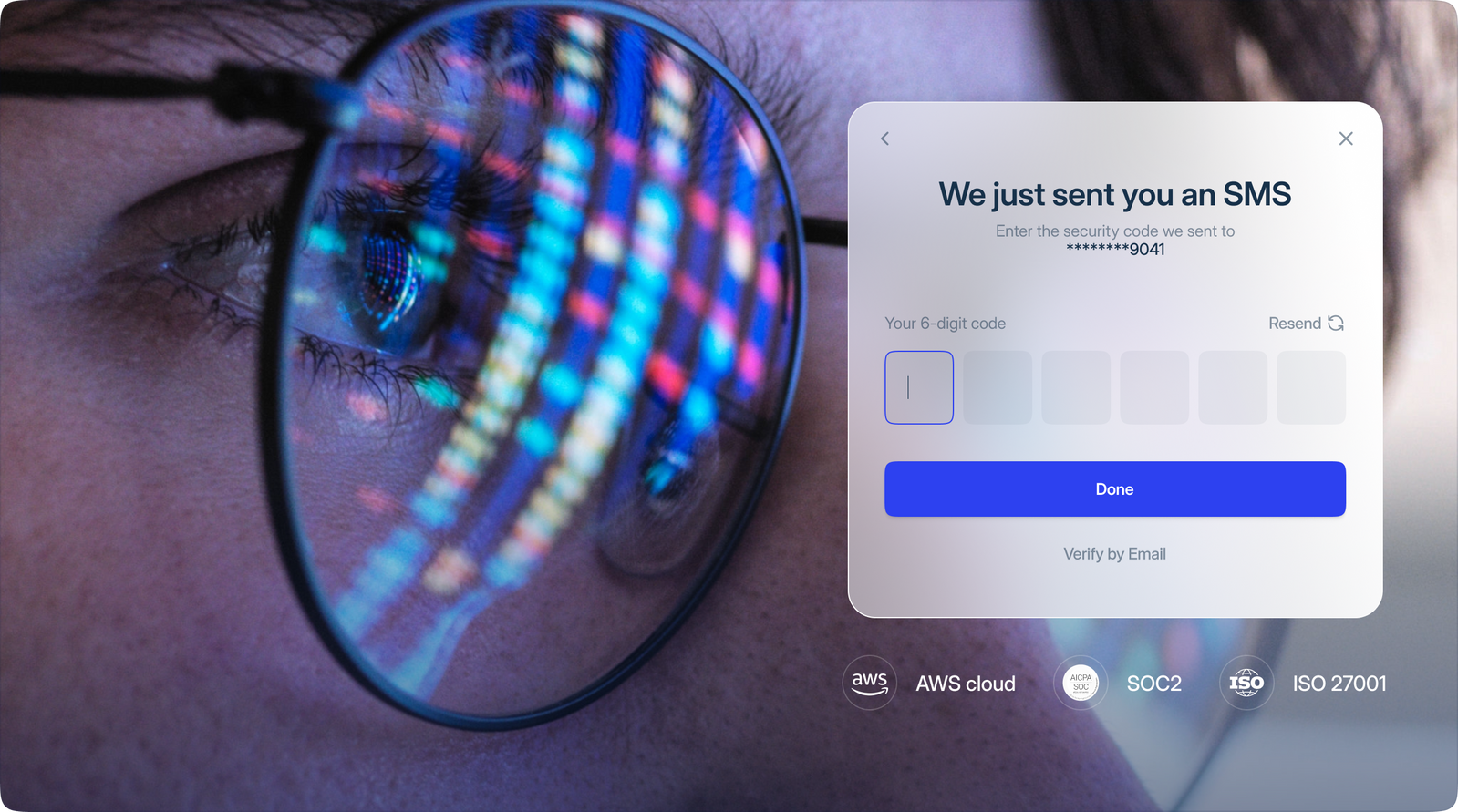

Mitigate risk

Enhance payment security, lighten the load of reporting, and make regulatory compliance a breeze.

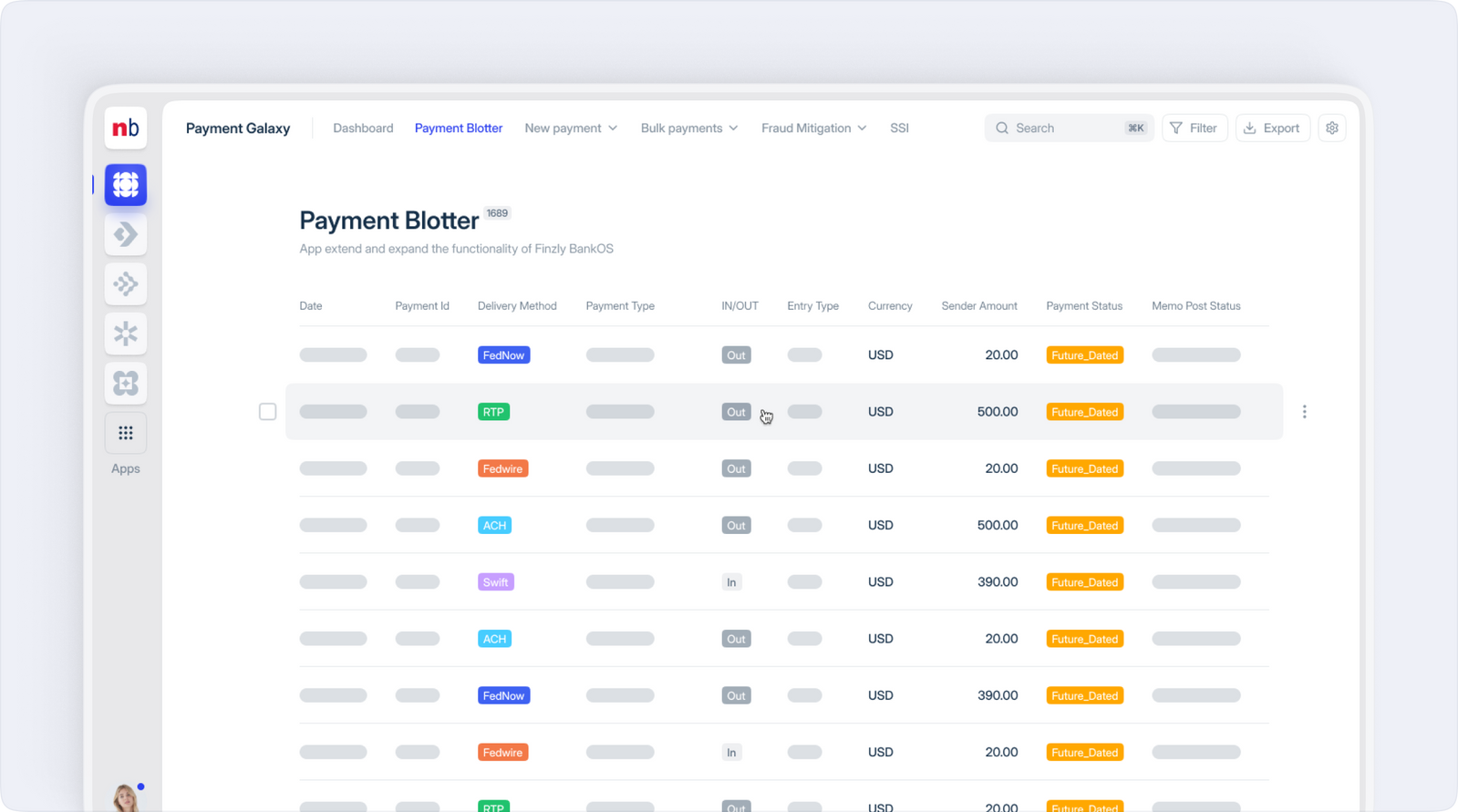

Stay informed

Get a birds‑eye view of payment activities across all rails, and leverage advanced analytics to back up big decisions.

Omnichannel payments

Facilitate payments through bulk files APIs from internal and external applications, or digital banking experiences.

Smart payment routing

Faster or cheaper? Our sophisticated orchestration layer supports rules‑based smart routing based on speed, cost or availability of the recipient bank on the network.

Customizable workflows

Define your own workflows to suit your compliance measures such as approvals, callbacks, limit checks, OFAC screening and fraud detection.

Seamless integration

Finzly’s Payment Hub works seamlessly on top of your current systems to create a cohesive, end-to-end ecosystem.

Enriched payment data

Automatically enrich payment messages with your core, CRM and GL systems and unlock valuable insights for strategic decision‑making.

Reliable settlement

Get the benefit of Finzly’s certified and managed connections to the Fed, SWIFT, and TCH – for secure and efficient payment settlements.

One platform, infinite possibilities

Streamline workflows, reduce overheads, and unlock new revenue streams. All from one integrated solution. One platform, one API, one UX, one training program, one update and one view for all types of payments.

Insights

Datos Report: Payments Modernization at FIs — Your Competition May Already Enjoy the ROI

5 Payment Modernization Trends to Watch in H2 2025

Webinar on demand: Maximizing ROI of payments transformation — what banks need to know

The Creeping Payments Crisis: Why 70% of Large Banks Are Falling Behind in Payments

Payments trends that will define 2025

American Banker Webinar On Demand: The Rise and Rise of Payment Hubs

Payment Modernization Strategies for Mid-Sized Banks: Preparing for 2025 and Beyond

Instant Payments and Payments Hubs: Is a Payments Hub the Missing Piece to your Payments Puzzle?