Payments and international banking, simplified

Imagine, innovate, thrive

Imagine instant adoption of real‑time payments, with the data-rich ISO 20022 standard. Imagine scaling with multi-channel ACH, built for the modern age. Imagine offering wide-ranging money movements solutions that are cost-effective, future-ready and hyper-efficient. Imagine seamlessly integrating everything, without replacing your legacy and core systems. Empowering you to create new products in just a few days – and launch them in just a few weeks. With Finzly, it’s all possible.

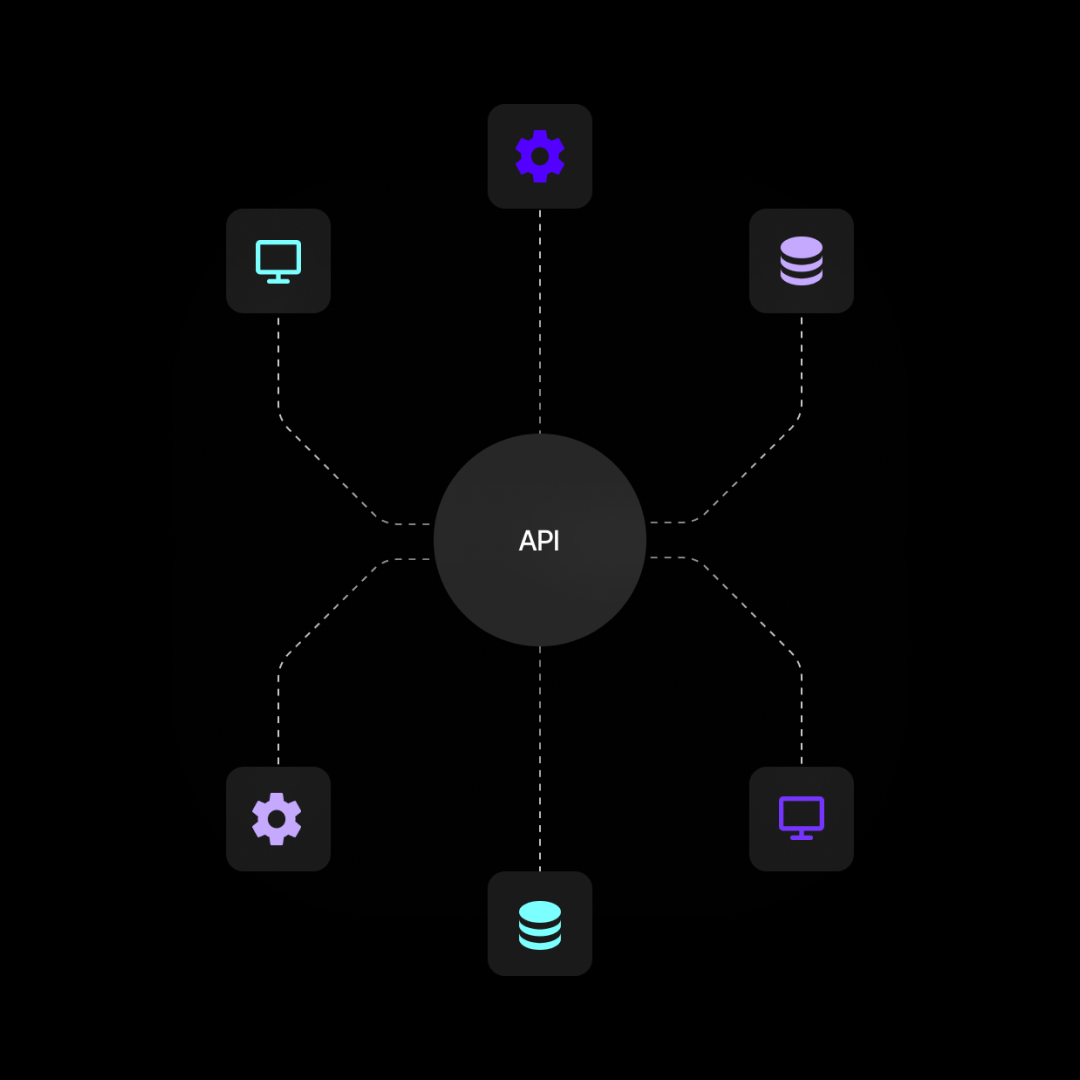

Payment Galaxy — instant, easy payments

Experience a real‑time money movement platform, with managed connections to every payment network. Choose your rail, and transform your payment processing by launching ready-to-go applications. With one API, one interface, one payments team, and one training program, Payment Galaxy is the ultimate next‑gen payment hub.

Account Galaxy — real‑time, dynamic deposits

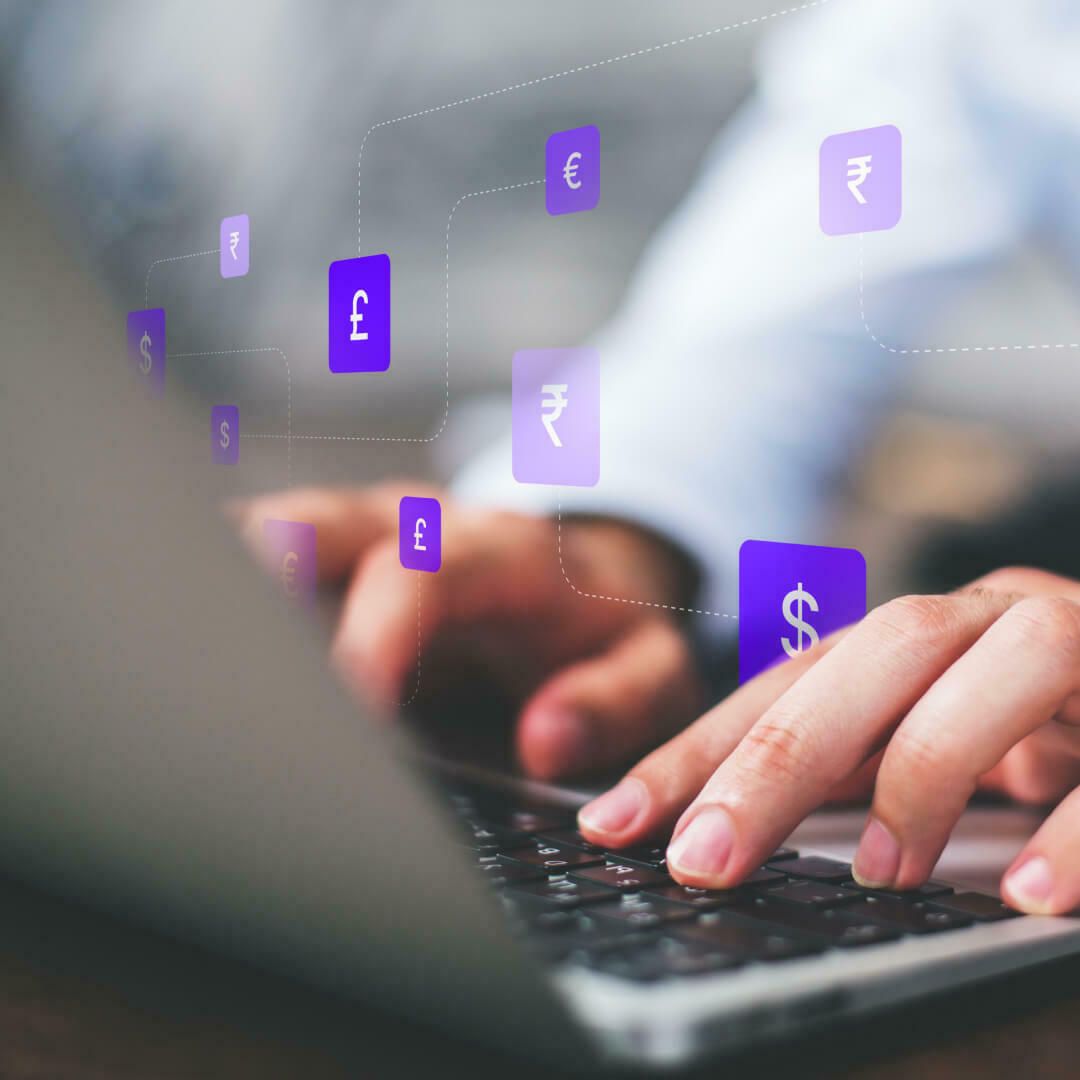

Craft hyper-tailored experiences to partners in embedded banking with flexible deposit products. Offer virtual accounts with multi-currency and multi-asset support — fit for today’s globally connected businesses and consumers.

Digital Galaxy — flexible, intelligent payment experiences

Experience the joy of a digital banking platform that’s fully flexible to your needs. Empower businesses, consumers and bankers to manage finances with unrivaled ease across every payment rail.

Open Galaxy — Next‑gen embedded banking

Enable your corporate clients and fintech partners to integrate banking services with our advanced APIs. Advanced capabilities for onboarding, payments, deposits, virtual accounts, foreign exchange, and accounting in real‑time on a 24/7 cloud platform.

Trade Galaxy — Excellence in international banking

Offer award-winning Foreign Exchange services to treasury and commercial customers with full control over pricing, and better visibility throughout the lifecycle. Combine FX with our Trade Finance application for a complete international banking experience.