The ACH Dilemma: Can Banks Keep Up with Booming Growth?

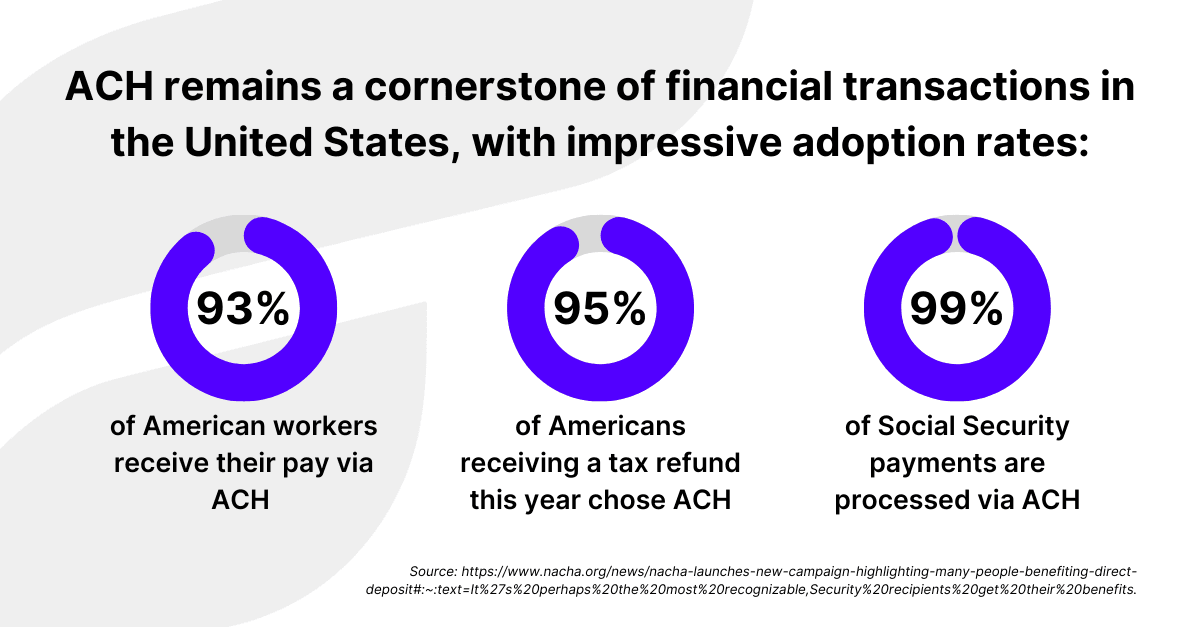

ACH has undoubtedly become the lifeline of the B2B economy and a silent revenue generator for banks through commercial transactions, government payments, and vertical-specific uses like healthcare and payroll. With this unprecedented growth, a critical question emerges: Are banks' ACH payment platforms equipped to handle this explosive growth and meet changing demands?

Despite ACH solutions being the backbone of business customer services, financial institutions have historically managed these systems in a monolithic and change-resistant "black box" manner. While this approach was sufficient in the past, changing customer expectations for transparency, speed, and simplicity are now driving banks to overhaul both their backend ACH systems and the front-end customer experience.

Banks can no longer treat ACH like the old workhorse in the stable. They need to embrace advancements like Same Day ACH and make their systems and processes more efficient and agile to keep pace with the emerging payment rails.

The Factors Driving ACH Transformation

Lack of support for existing systems

Despite ongoing updates to meet evolving regulatory requirements and industry standards, legacy ACH processing systems at financial institutions remain deeply entrenched in outdated technology paradigms. This dependence on antiquated architectures poses substantial support challenges, compounded by a scarcity of mainframe-skilled resources and expertise in legacy systems.

Support for legacy ACH systems is quickly disappearing, prompting banks to reevaluate how they handle these payments, The clock is ticking towards potential failure, and banks are gearing up to explore alternative solutions.

Operational efficiency demands

Managing back-office operations for ACH has always presented challenges. Many existing ACH systems function as opaque black boxes, forcing bank staff to dedicate considerable time to troubleshooting and managing routine, low-value tasks. These systems often lack transparency, offering limited real-time insights into Fed-bound files and transaction statuses buried within their complex structures. This scenario has created a pressing need for improved operational experiences, driving banks towards ACH systems with enhanced dashboards and real-time reporting features.

When we look at the current systems in financial institutions, it's surprising how little visibility bankers have into how files sent to the Fed or the status of transactions when they process ACH payments. These processes are so embedded in legacy systems that bankers are increasingly demanding greater transparency and control over ACH transactions.

Echoing this sentiment, Bhaskar highlights three key aspects banks are seeking in modern ACH processing:

- Simplicity: Easier user experience and reduced operational complexities.

- Modularity: Greater flexibility for seamless upgrades and integration with new technologies.

- Transparency: Clearer process visibility to build trust and ease troubleshooting.

Enhancing user experience

Improving the end-user experience is a critical driver for ACH transformation. Many outdated ACH systems lack the intuitive interfaces and controls expected by modern B2B clients. According to Datos Insights, 94% of businesses plan substantial investments in payment modernization over the next 2-3 years. To stay competitive and meet the changing needs of clients, banks need to offer advanced API-driven interfaces, efficient file transfer systems, and better tools for managing risks, including positive rules, block lists, and recurring payments. Increased transparency, real-time notifications, and expanded processing windows with Same Day ACH are essential for ensuring speed and transparency, crucial for optimal cash flow management.

Overcoming the "If It Ain't Broken, Don't Fix It" Mentality

Financial institutions have long clung to the "if it ain't broken, don't fix it" philosophy regarding ACH systems. However, this resistance to change is becoming increasingly unsustainable. The emergence of instant payments and Fedwire's transition to ISO 20022 standards are catalyzing a reassessment of existing infrastructures. Financial institutions are beginning to see the benefits of central payment hubs capable of anticipating and adapting to these new standards.

Strategic Approaches to Modernization

While many banks are hesitant to change what works, more payment strategies are now including ACH transformation in various capacities to meet demands from B2B customers.

ACH modernization strategies in financial institutions should tackle current pain points while paving the way for long-term transformation.

Financial institutions are exploring several strategic pathways to modernize their ACH processing:

- Orchestrated Payment Capabilities: Enhancing existing ACH engines with centralized control and exception management, preserving investments in their current ACH payment processors while improving oversight.

- Parallel Processing Systems: Implementing cutting-edge ACH processing on separate routing numbers to serve modern B2B customers and fintech partners without depending on incumbent systems.

- Comprehensive Payment Hub Migration: Integrating ACH processing into a unified platform alongside domestic and international payment rails for streamlined operations.

- User Experience Transformation: Fintechs such as Square and Stripe are leading the way with superior user experiences, offering effortless ACH transfers through their mobile apps and seamless API integration with accounting software. In response, financial institutions are transforming user experiences for their customers through streamlined workflows for businesses for accepting ACH payments and making B2B payments, moving away from fragmented systems and interfaces.

The Future of ACH Processing

ACH processing systems are increasingly seen as essential, robust components of financial infrastructure rather than outdated, cumbersome relics. The era of blackbox ACH processing is drawing to a close. The future lies in transparent, modular systems that can adapt to the needs of businesses and consumers alike. For banks, the message is clear: modernize or risk falling behind.

To learn more about Finzly’s modern ACH solution, visit ACH Payments.

Get the monthly newsletter

Get the Finzly edge through our insights