The New $10 Million Real-Time Payments Limit Changes Everything for Investment Banking

An A2A payment simply moves money directly from the payer's bank to a merchant or service provider's bank. A2A transfers powered by instant payments infrastructure is catching up in use case in the space of C2B payments, especially e-commerce.

Merchants have been resorting to cards and wallets for the convenience and reach they provide to customers. However, with the advent of instant payments, there is a true challenge to the dominance of cards. While this is felt more in the developing economies, there is no doubt that the convenience and low costs of A2A will certainly make it a popular choice for the US merchants too.

The Fed is promoting use cases that support A2A payments using instant payment rails. Moving A2A payments on the FedNow® or the RTP® networks will eliminate the need for intermediaries, reducing friction and cost, while increasing efficiency. With the government's recent backing of open banking, cost-efficiency combined with the power of data provided by the ISO 20022 standards of instant payments will fuel more value to the end customers and merchants alike.

What's happening across the pond?

Looking across the pond to our closest neighbor UK, where faster payments have been around since 2008, the pandemic saw a great growth in A2A payments. 54% of B2B payments were routed through the Faster Payments network in 2020, seeing a growth of 21% increase in volumes year-on-year. A great promise for A2A indeed!

In Netherlands, with the iDEAL payment system, A2A transfers are powering more than 50% of e-com transactions. Denmark is also catching up. Sarah Lauridsen, Head of Products and Solutions at Banking Circle, that powers A2A solutions across instant payment network comments, "A2A payments have become the go-to solution for e-commerce in Denmark."

A2A goes cross-border

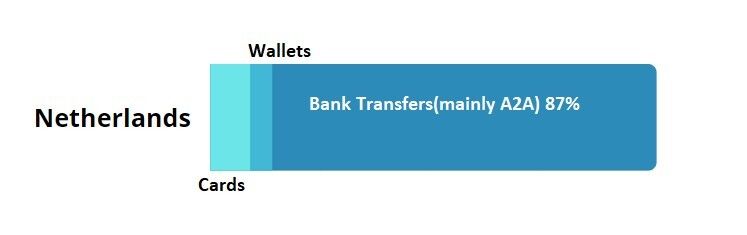

The case of Nordics is interesting when it comes to cross-border payments. The similarity of consumer behavior and business demographics has been broken up by distinct payments infrastructure across the different Nordic countries, making bank transfers and cross border payments unwieldy. This has given birth to P27 — an inter-bank initiative that will introduce a uniform inter-bank pan-Nordic cross border A2A payments infrastructure, reducing the cost and increasing the efficiency of payments. As per Global Data, close to 87% of e-com transactions in the Netherlands are bank transfers on A2A rails, powered by instant, wires and ACH payment rails, depending on the nature of the payment.

What should banks do take advantage of this immense opportunity?

A2A transactions are 90% cheaper to merchants. Many banks are taking control of their payment rails to facilitate A2A transfers across a variety of payment rails including wires, instant payment rails and ACH, which will eventually keep the big card players at bay. Moving money directly between bank accounts without intermediaries is a great opportunity for banks, helping them compete with the likes of PayPal, who still depend on card rails.

Bank transfers on A2A rails is certainly a great opportunity for banks that have the right payment infrastructure facilitating interoperability. Payment hubs which offer interoperability of multiple payment rails are becoming the go-to solution for banks, with more than 8 in 10 banks tending towards hubs as part of the modernization exercise.

Banks are getting ready to adopt FedNow/RTP in preparation for the A2A opportunity

Banks that prepare their engines to offer A2A on instant payment networks will certainly get a head start. With instant payment services promising equitable access for all banks, irrespective of their asset size, the early adopters are expressing interest in FedNow and RTP adoption. With the support of trusted technology partners, they can embrace the vision of The Faster Payments Task Force to promote inclusion and ubiquity, giving the benefit of cost and efficiency to their customers.