Supercharge BaaS revenue growth

Onboard fintechs and partners in minutes

Easily integrate fintech partners for embedded banking without needing a separate BaaS platform. With Finzly’s real-time, 24/7 virtual accounts and virtual ledger, you can onboard partners in minutes, fully customized to meet your reporting and their specific needs. Maintain complete control and visibility while ensuring compliance with FDIC regulations - all without depending on core systems or third-party providers.

Benefits you can bank on

More revenue streams

Increase BaaS and embedded banking revenue without sharing profits with BaaS platforms or incurring platform fees.

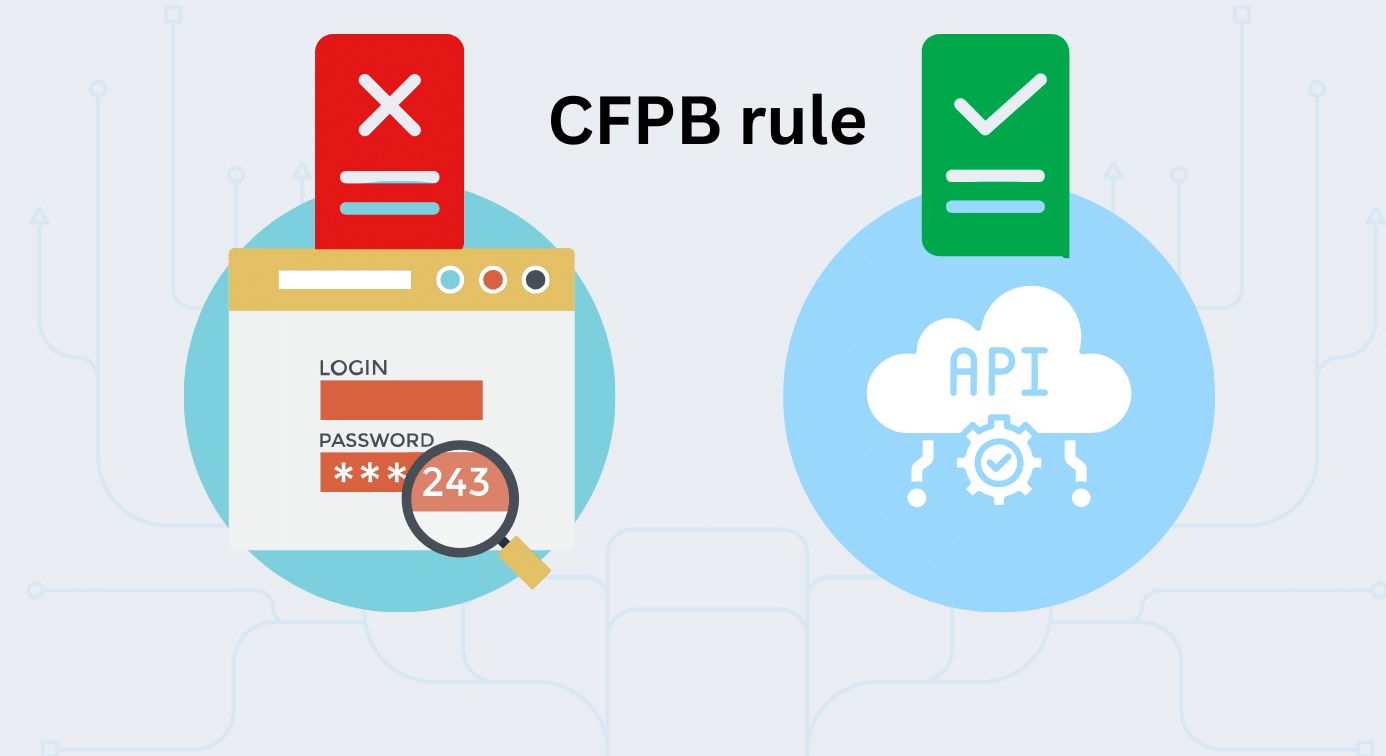

FDIC rule compliant

Achieve regulatory compliance and transparency with our FDIC-compliant accounting and reporting.

24x7 embedded banking core

Real-time, always on: no missed transactions.

FedNow-powered deposit accounts

Be the first to offer APIs for FedNow-enabled deposit accounts to fintechs and corporations, granting them access to all payment rails through a single integration.

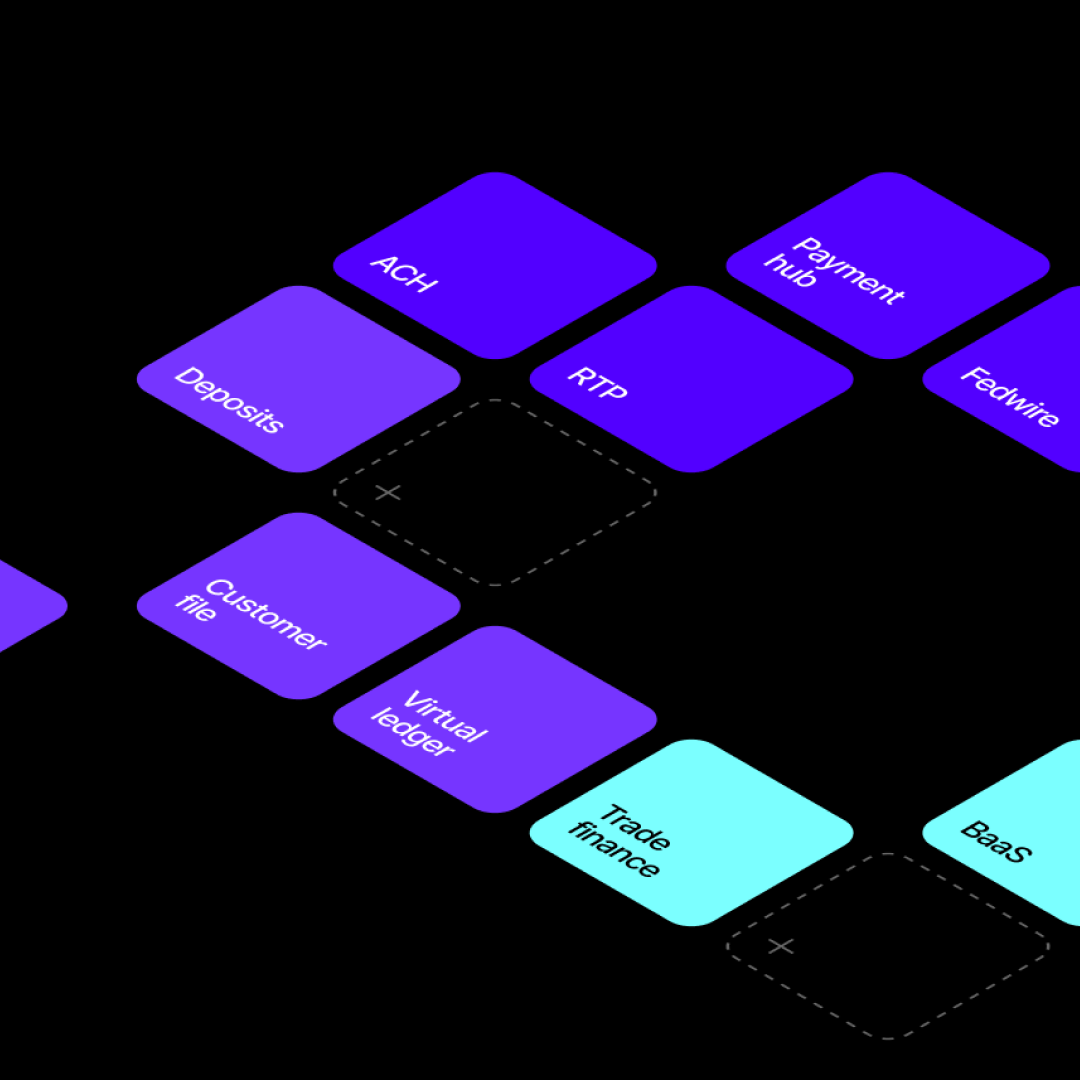

A comprehensive embedded banking core

Say goodbye to fragmented APIs, BaaS platforms and isolated legacy systems. With Finzly BankOS, you can attract fintechs with APIs for payments, deposits, virtual accounts, foreign exchange, and advanced accounting - all within your bank's estate. This all-in-one operating system serves as your embedded banking core. Our real-time, 24/7 scalable platform empowers you with complete control, full visibility, and unmatched agility to grow these partnerships.

Diverse collection of open APIs

Allow fintechs and corporate customers to embed open APIs for payments, deposits, FX and fintech accounts.

Unified payments API

Offer a unified API for all payment types – ACH, wires, FedNow, RTP.

Real‑time virtual accounts

Create an unlimited number of virtual accounts for your fintech partners for custodial and beneficial accounts, providing real‑time visibility and cost savings.

Integrated ledger

Offer fintechs a fully integrated virtual ledger, enabling seamless reconciliation with real-time accounting.

White‑labeled platform

Offer a fully white‑labeled, turnkey BaaS platform – pre‑loaded with a suite of open APIs and developer documentation, including access to sandbox to help them test and launch their products.

Insights

The FDIC push that’s driving banks to bring BaaS home

The FDIC’s New BaaS Rules Explained: 5 Actionable Insights for Sponsor Banks

6 CFPB Rules Financial Institutions Must Know for BaaS and Open Banking

Why Virtual Accounts Are Back in Vogue

Datos Report: Virtual Ledgers — A Powerful Tool for Managing Fintech Relationships

Webinar On Demand – Embedded Banking with Brett King