FedNow® success in 8 weeks. Don’t get left behind.

Deliver the full FedNow® experience

Offer more than just “Receive”. Most FedNow® providers stop at the minimum. Finzly gives you the complete package:

- Instant Send

- Real-time Receive

- Built-in Request-for-Payment (RfP)

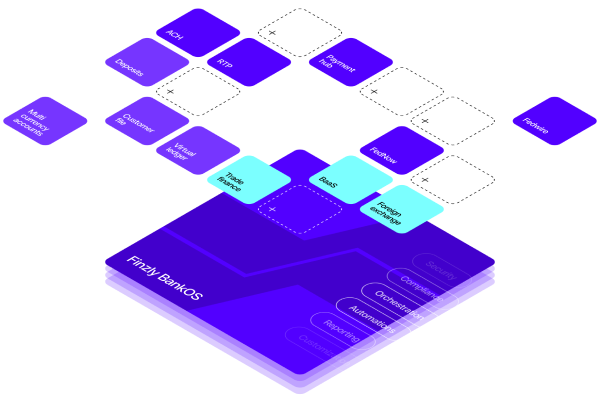

Built on flexible APIs for revenue growth, with ready-to-use digital experiences that easily connect to your digital banking. Integrate easily with online and mobile banking, treasury portals, ERP/accounting platforms, fintechs, and embedded finance tools.

Benefits you can bank on

All-in-One platform modernization

Turn FedNow® into revenue; not just cost

Go beyond basic ‘receive-only’ capabilities. Finzly enables revenue-generating services like Request-for-Payment, instant disbursements, and API-based instant payments for embedded banking revenue.

Core-independent, proven at scale

Go live fast, without waiting on your core.

Skip the long timelines tied to core and digital banking systems. Tested at scale by AWS for large bank volumes, Finzly delivers FedNow® in as little as 8 weeks.

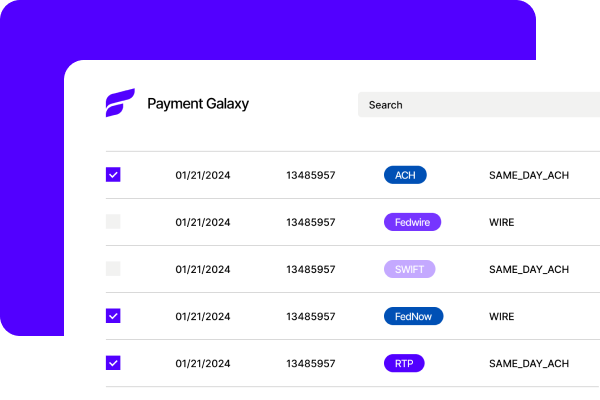

RTP® & FedNow® send experience

Send. Receive. Request; All in one platform.

Offer your customers the full FedNow® experience, including instant send, real-time receive, and built-in RfP. No partial solutions — deliver it all through one flexible API and digital experience.

Multi-channel support

Send, request and receive instant payments 24/7, 365 days of the year through multiple channels – APIs, bulk files, digital banking and in-branch.

Seamless integration

Enjoy smooth onboarding with our ready-to-go FedNow solution that integrates with your internal systems and your core.

Instant fraud protection

With integrated real-time fraud monitoring and compliance, it’s your first and last line of defense against fraud.

Smart routing

Network outage? Processing bottleneck? Mitigate the risk of payment failures or delays by automatically rerouting transactions to other rails.

Finzly Payment Hub

Manage all payment rails in a modern, unified experience.

Built for revenue-driving use cases

Finzly enables high-value, real-time payments through flexible APIs and intuitive digital experiences.

- Enables utility providers and lenders to initiate payment requests with ease and speed.

- ERP-connected supplier payments for corporate clients

- Instant disbursements for title companies and insurers

- Immediate tax refunds and government disbursements

- Just-in-time payroll and treasury movement for SMBs

Built for 24/7 real-time scale - proven at Big 4 bank volumes

Insights

FedNow® Provider Checklist: 10 Questions Every Financial Institution Must Ask

Managing Risk and Fraud in Instant Payments on FedNow® & RTP®

Webinar On Demand: Radically Simple Instant Payments: How Credit Unions Can Quickly Modernize Payment Infrastructure

Instant Payments Made Easy: How credit unions can quickly modernize payment infrastructure

Instant payment adoption: Are banks future-proofing or self-limiting?

Payments trends that will define 2025

Payment Modernization Strategies for Mid-Sized Banks: Preparing for 2025 and Beyond

Instant Payments and Payments Hubs: Is a Payments Hub the Missing Piece to your Payments Puzzle?