What banks need to know about FedNow and RTP pricing

Understanding the pricing of RTP® and FedNow® instant payments

There has been heavy investment in technology to develop the underlying infrastructure to support the speed, immediacy and digitization around instant payments. Apart from a few countries like Mexico, where the existing payments platform have been upgraded to cater to instant payments, infrastructure has been designed ground-up to handle the high volumes and values of instant payments.

Across the world, instant payment infrastructure development has been funded by two main categories:

- Public authorities — specifically central banks as in the case of Australia

Public authorities, in particular the central bank, provide funding for the development of the faster payment infrastructure and often maintain full ownership of the arrangement as in the case of FedNow. Other examples include Australia, China and Mexico.

- Private Sector

Often, the infrastructure is owned by a private entity or an association, as in the case of TCH's RTP and the Faster Payments in UK.

The 3 components of participation fees

Banks wanting to participate on instant payment networks end up paying different fees to avail the service of instant clearing and settlement. A few providers offer fixed fees, often higher for bigger banks, but offer volume-based discounts for transactions later. Strategies could also include offering lower fixed fees for participants with lower transaction volumes.

Whatever the strategy, the operators aim to recover the investments made on the infrastructure and cover the expenses to keep the infrastructure operational.

Fees that participants pay to avail the services include:

- Onetime joining fee — the admin overhead for onboarding

- Transaction fee — mainly to cover the operating expenses

- Annual fee — to recover investments costs and to take care of the upkeep of the system

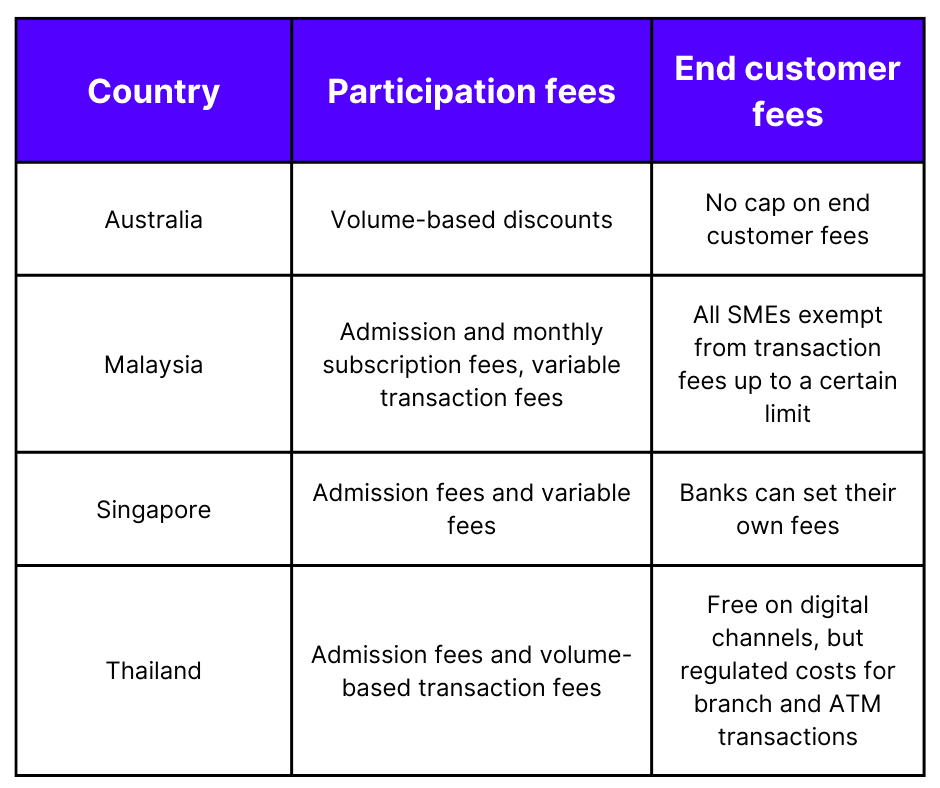

Here is an insight into how operators in different countries structure the participation fees:

How does the US compare?

RTP follows a single and uniform pricing structure for all participants. There are no thresholds on monthly minimums and volumes. Unlike several other countries, there is no admission fees to join the system. The transaction fees are per transaction and are volume-agnostic, with an inter-participant fee in the form of a "Request for Payment" fee to cover the cost of sending and honoring the RFP. Additionally, a recurring monthly fee for network connectivity fee is also charged to participants with a direct connection.

The fee for sending credit transfer messages is $0.045 — to be paid by its sender, including returns. Request for payment (RFP) message incurs $0.01 to be paid by the requestor, wherever payments have been requested or funds need to be returned.

There is full freedom for the RTP participants to decide the final transaction charges that apply to end customers using the service.

The benchmark for banks

Studies from AFP show that real-time payments can be a low-cost alternative for wires, as they have the characteristics of irrevocability and real-time gross settlement. The declining volume of checks and the unfavorable cost of processing them are already showing a slow death in other geographies that have embraced instant payments. For banks to see the benefits of instant payments, a benchmark of the median costs involved in processing each payment type can give a good indication of the cost advantage that instant payments offer to them.

Median cost to process different payment types

Thankfully, the pricing structure of instant payments for banks is a fully transparent structure for both FedNow and RTP. There are no volume discounts, making it a level playing field for banks of all sizes. The flat pricing model is expected to make adoption ubiquitous across the ecosystem — the government, clearing houses, financial institutions, consumers, and businesses.

Get the monthly newsletter

Get the Finzly edge through our insights