Go further, faster with Fedwire ISO 20022

Fedwire processing, fit for the future

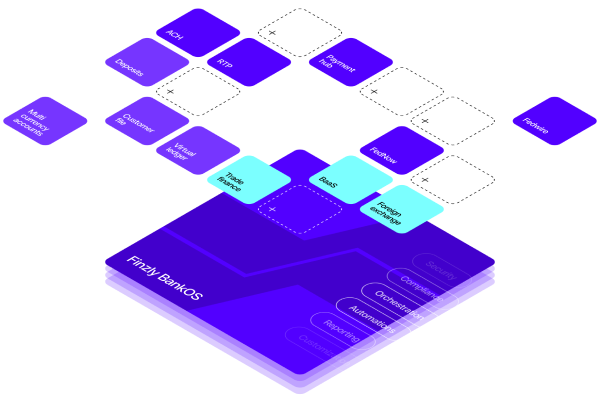

Process wires on a Fed certified ISO 20022-native platform and harness the rich data capabilities of the global standard for payment processing. Think frictionless integration, optimized efficiency and future-proof compliance. All seamlessly connected to your core and other systems with the ability to post in real‑time, available 24/7.

Benefits you can bank on

Accelerates speed to market

Our pre-wired, tested and certified connections to the Fed keep you a step ahead to implement Fedwire, keep up with ISO 20022 standards, and launch value-added services.

Enhances compliance capabilities

Eliminate the burden of compliance with robust controls, monitoring, and reporting to meet evolving regulations, mitigate risks, and promote transparency and accountability.

Faster settlements, greater customer experience

Enjoy up to 70% faster Fedwire processing, offering faster, transparent and more efficient payment services.

Cost optimization and efficiency

Streamline payments, automate tasks, and reduce errors for cost savings and efficiency, enabling banks to pursue strategic initiatives.

Grow revenue

Increase revenue by offering Fedwire APIs to corporate customers and fintechs who want to embed Fedwire payment processing from their platforms.

ISO 20022-native

Send, request and receive wires through APIs, messages or digital banking in the ISO 20022 standard on a Fed certified ISO-native platform.

Workflow automation

Define and customize internal processes and controls. Streamline operations with flexible, automated and auditable workflows including approvals.

Award-winning experience

Give your business customers an exceptional wire payment experience to send, request, and receive wires, with real‑time notifications.

Open APIs

Offer complete APIs to internal and external ecosystems, helping them embed wire payment processing in their experiences with real‑time notifications.

Real-time notification

Enhance customer experience with real-time notifications via webhooks and FTP, ensuring timely updates and engagement with your platform.

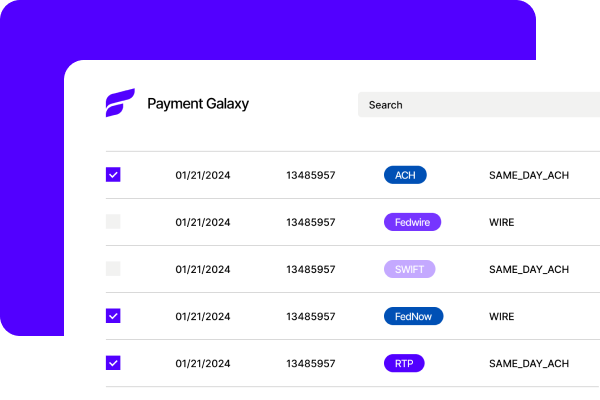

Multichannel Fedwire connectivity

Support for initiating Fedwire transactions across multiple channels and interfaces – including APIs, bulk files, branches, and digital banking.

Upfront validation checks

Get granular upfront validation of limits, duplicates, fraud, counterparties, balances, and accounts to minimize payment failures.

Sweep transaction automation

Send, request and receive instant payments 24/7, 365 days of the year through multiple channels — APIs, bulk files, digital banking and in-branch.

Finzly Payment Hub

Manage all payment rails in a modern, unified experience.

Enjoy up to 100% STP on an ISO 20022-native Fedwire platform

Imagine being fully-prepared ahead of deadlines — ensuring up to 100% STP and reducing wire settlement times with complete automation. Our Fedwire solution is already Fed certified for ISO 20022. This lets your bank process messages in the new format before the deadline. It also gives you deeper insights into customer transactions, behavior patterns, and preferences.

Powered by a scalable, real‑time, 24/7, resilient architecture

Insights

Fedwire’s ISO 20022 Migration: Why It Matters - and How Institutions are Gaining an Edge

Surround, Shrink, Scale: The Legacy Exit Strategy for Payment Modernization

Wings CU goes live on Finzly’s Fedwire in just 4 months, achieving seamless ISO 20022 compliance

American Banker webinar on demand— Payments that never sleep: Future-proofing Fedwire & ACH transformation at large banks

Preparing for Fedwire ISO 20022: How Finzly’s Solutions Bring Value to Financial Institutions

Instant Payments and Payments Hubs: Is a Payments Hub the Missing Piece to your Payments Puzzle?

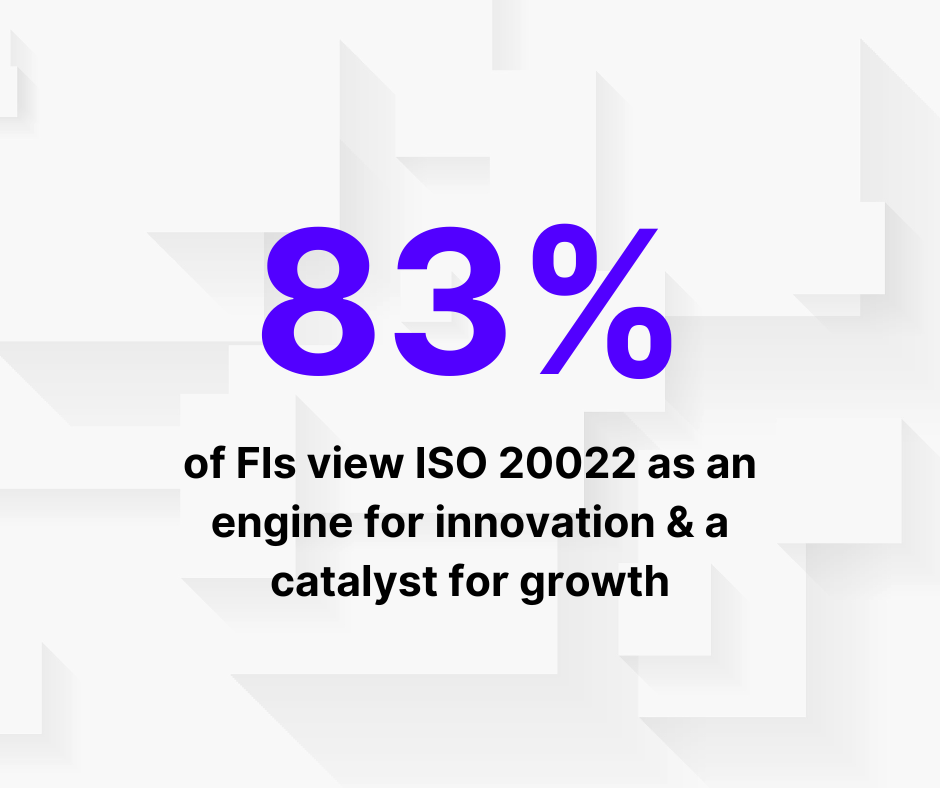

ISO 20022: The Untapped Opportunity for Financial Institutions

ISO 20022 for Fedwire: A Strategic Imperative for Financial Institutions